California’s automotive landscape in 2024 presented a mixed bag of trends, according to the California Auto Outlook Report from the California New Car Dealers Association (CNCDA). While the overall 2024 New Car registrations remained stable, significant shifts are occurring within the electric vehicle (EV) market and the growing popularity of hybrid vehicles. This report, using data from Experian Automotive, delves into these key developments and what they signal for the future of the California auto market.

CNCDA 2024 California Auto Outlook Report Cover Page

CNCDA 2024 California Auto Outlook Report Cover Page

Tesla’s Market Share Adjustment in the 2024 New Car Landscape

A notable trend in the 2024 new car market is the adjustment in Tesla’s dominance within the EV sector. The report indicates that Tesla experienced its fifth consecutive quarterly decline in registrations, with a 7.8 percent drop in Q4 2024 and an 11.6 percent decrease overall for the year. Consequently, Tesla’s market share in the Zero Emission Vehicle (ZEV) segment decreased by 7.6 points, settling at 52.5 percent for 2024. Looking at the broader California 2024 new car market across all brands, Tesla’s share is 11.6 percent, down from 13 percent in the previous year. This suggests a shifting dynamic within the EV market, with increased competition and evolving consumer preferences influencing brand distribution.

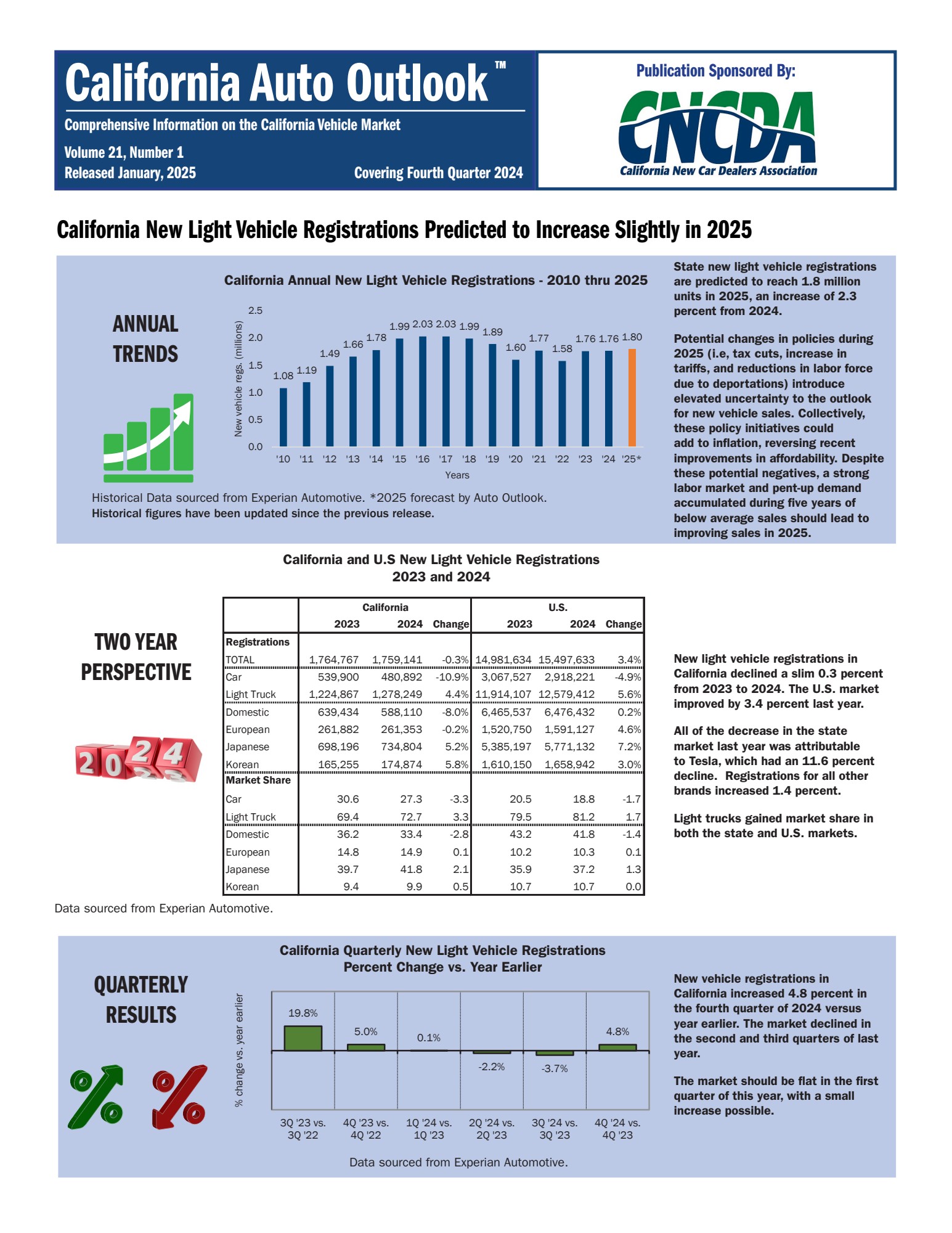

Stable 2024 New Car Registrations and Optimistic 2025 Projections

Despite the changes within the EV market, the total 2024 new car registrations in California demonstrated stability. The state recorded 1,759,141 light vehicle registrations, showing a minor decrease of only 0.3 percent compared to 2023. Looking ahead, the outlook for 2025 is positive, with projections anticipating a slight increase to 1.80 million registrations. The fourth quarter of 2024 itself showed a promising 4.8 percent increase in registrations compared to Q4 2023, indicating positive momentum as we move into 2025. However, the report suggests a relatively flat performance for the first quarter of 2025.

Hybrid Vehicles Gain Traction in the 2024 New Car Market

One of the most significant shifts observed in the 2024 new car market is the changing consumer preference within the alternative powertrain sector. While the ZEV market share experienced a slight dip to 21.3 percent in Q4 2024 (from 23.7 percent in Q3), hybrid vehicles stepped in to fill the gap. Hybrids saw a 2.4 percentage point increase in Q4, directly mirroring the ZEV registration decline. For the entire year, alternative powertrain registrations reached 40.2 percent, and 42.2 percent in Q4. This trend suggests that California consumers might be opting for a more gradual transition from traditional internal combustion engines (ICE) to full EVs, with hybrids becoming an increasingly attractive intermediate option in the 2024 new car selection.

According to Robb Hernandez, CNCDA Chairman, California dealers are focused on providing the vehicle choices that customers demand, be it hybrids, EVs, or traditional models. The emphasis is on meeting consumer needs with the right inventory, rather than pushing specific powertrain types.

Brand Performance in the 2024 New Car Market

Toyota emerged as the leading brand in California’s 2024 new car market, capturing 16.4 percent market share with 289,258 registrations, a 4.4 percent increase from the previous year. Following Toyota, Tesla and Honda shared the lead, with Honda experiencing an impressive 11.5 percent increase in registrations, reaching 192,166 vehicles. Several brands also showed remarkable growth in registrations in 2024, including Lincoln, Land Rover, Cadillac, and Buick, all exceeding a 20 percent increase.

Top Model Segments in the 2024 California New Car Sales

In terms of model segments within the 2024 new car market, the Toyota Camry led the passenger car category, while the Tesla Model Y was the top-selling light truck. The top three passenger cars were closely contested, with Toyota Camry, Honda Civic, and Tesla Model 3 leading the pack. In the light truck segment, the Tesla Model Y, Toyota RAV4, and Honda CR-V were the best sellers.

Regional Variations in 2024 New Car Trends

Regional differences were also evident in the 2024 new car market within California. Northern California saw a larger decline in passenger car registrations compared to Southern California, but a smaller increase in light truck registrations. ZEV market share was also slightly higher in Northern California (25.1%) compared to Southern California (22.7%).

In conclusion, the California 2024 new car market demonstrates stability with underlying shifts. While EV adoption continues, its growth is moderating, and Tesla’s dominance is being challenged. Simultaneously, hybrid vehicles are gaining significant traction, suggesting a nuanced evolution of consumer preferences in the state. The 2024 new car market data provides valuable insights for industry stakeholders as they navigate the evolving automotive landscape in California.