The global electric vehicle (EV) market in the first half of 2024 presented a fascinating mix of triumphs and challenges for manufacturers. As consumers increasingly consider the switch to electric, the question on everyone’s mind is: which EVs truly stand out as the best on the market? This analysis, drawing insights from EV Volumes founder Roland Irle, delves into the performance of key players and identifies emerging trends shaping the landscape of the best EVs available.

While regional growth patterns heavily influenced OEM success, particularly benefiting Chinese automakers, the quest for the best EV transcends geographical boundaries. Let’s examine which manufacturers are leading the charge and what makes their offerings contenders for the title of “best EV.”

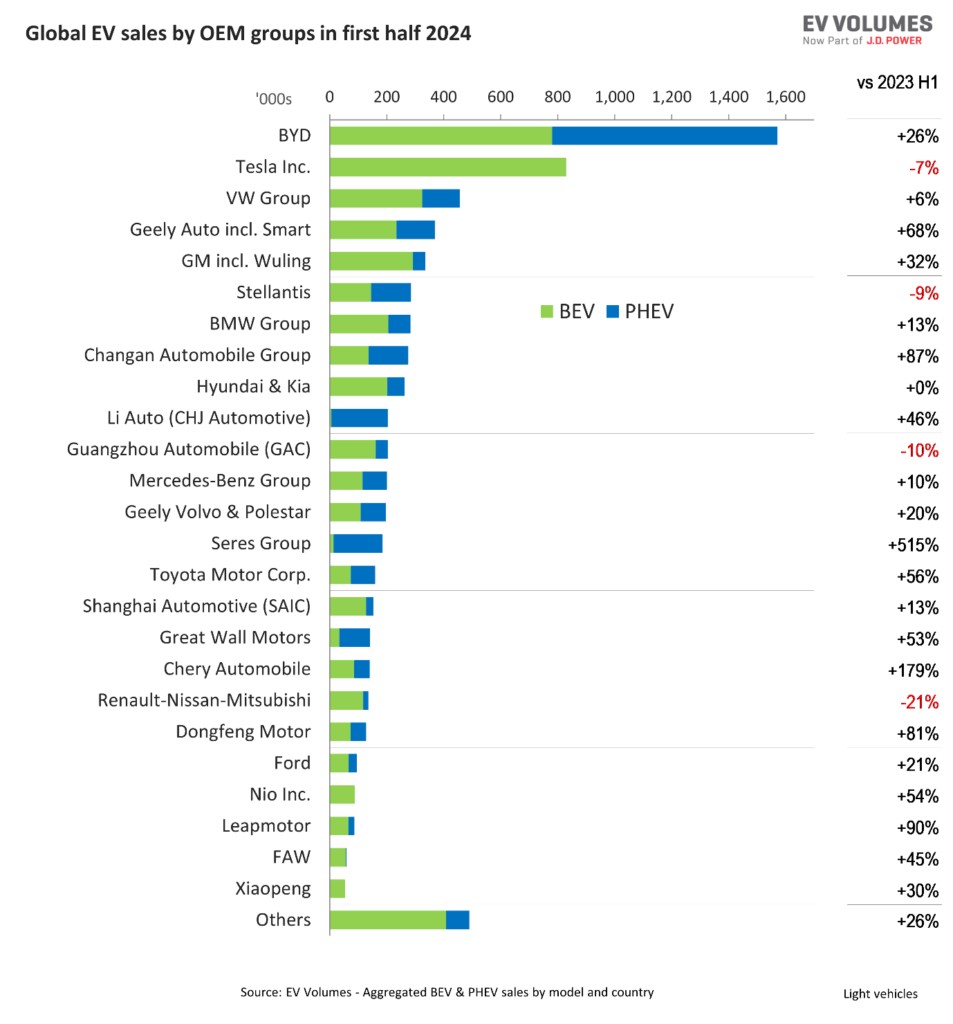

Many Chinese vehicle manufacturers demonstrated remarkable growth in the first half of the year. Brands like Geely, Changan, Li Auto, Seres (Aito), and Chery outperformed most Western OEMs, signaling a significant shift in the global EV market.

BYD, despite a slowdown in year-on-year volume growth to 26% (compared to 62% the previous year), maintained its position as the global EV market leader. With an extensive portfolio of 37 models, including battery-electric vehicles (BEVs), plug-in hybrids (PHEVs), and extended-range electric vehicles (EREVs), BYD’s diverse offerings cater to a wide range of consumer needs, making them a strong contender for providing some of the best EVs.

BYD's Dominance in the EV Market

BYD's Dominance in the EV Market

BYD’s strength extends beyond China, with substantial sales in South America, ASEAN, the Middle East, and Russia. However, their presence in Western and Central Europe remains relatively smaller, indicating room for further global expansion as they aim to offer their versions of the best EVs to a wider audience.

Tesla’s Resilience and the Pursuit of the Best BEV

Tesla retained its lead in global BEV sales in the first half of 2024, albeit by a narrow margin. A 7% year-on-year decline in deliveries, the first in this period, reflects increasing competition and evolving market dynamics. Despite facing challenges in China and rollout delays for the refreshed Model 3, Tesla continues to be a benchmark for BEVs, and many still consider their models among the best BEVs on the market.

Pricing competition in China and adjustments related to US Inflation Reduction Act (IRA) eligibility have impacted Tesla’s performance. However, their ability to adapt supply chains and logistics to navigate tariffs and incentives showcases their agility in the competitive EV landscape. The Model Y remains a top contender for the best EV in the SUV category, while the Model 3 continues to be a popular choice in the sedan segment.

Volkswagen (VW) Group experienced a slower growth rate of 6% in EV sales, compared to the global EV market’s 22% growth. While Audi and Cupra drove growth for the group, other brands faced declines. VW’s participation in the price war in China highlights the intense competition in this key market, as they strive to position their EVs as the best value proposition in various segments.

Geely’s Ascendancy and Volvo’s European Success

Geely emerged as a significant winner, tripling its global EV sector share. A 68% year-on-year sales increase for its Chinese brands and the impressive performance of its European affiliate Volvo underscore Geely’s growing influence in the EV market. The Volvo EX30 BEV, a new entrant, quickly became a hit with approximately 45,000 units sold in the first half, predominantly in Europe. This rapid success positions the EX30 as a strong contender for the best compact EV in the European market.

Geely's Growing EV Market Share

Geely's Growing EV Market Share

Geely’s exports from China, including Volvo, Polestar, and Smart, reached roughly 118,000 units, with a significant portion destined for Europe. However, potential import tariffs on Chinese EV exports to Europe may impact future growth, unless production is relocated or exemptions are secured. Geely’s strategic moves will be crucial in maintaining its upward trajectory in the global race to offer the best EVs.

GM’s sales grew by 32%, driven by new models on the Ultium battery platform gaining traction in the US. The Buick Velite 6 BEV in China also achieved record sales for the brand in the region. However, the phase-out of the Chevy Bolt impacted overall results. GM’s focus on its Ultium platform and expansion in China will be key to its competitiveness in offering some of the best EVs in the coming years.

Market Stagnation and Regional Variances

Stellantis experienced a 9% decline in EV deliveries, primarily due to its strong presence in Europe’s stagnating EV market. Subsidy cuts in Europe have particularly affected sales of lower-priced EVs, a significant segment for Stellantis. However, increased sales of Jeep, Dodge, and Chrysler models in the US and Canada indicate regional variations in EV market dynamics. Stellantis needs to adapt its strategy to navigate the challenges in Europe while capitalizing on growth opportunities in North America to ensure its EVs are considered among the best across different markets.

BMW Group achieved a 13% increase in EV sales, with the BMW brand experiencing solid gains, particularly in Europe. Mini, however, recorded significant losses. BMW’s success in Europe positions it as a strong contender in the premium EV segment, with models that are often cited as some of the best luxury EVs available.

Changan’s launch of new brands like Avatr, Deepal, and Qiyuan, with a diverse model lineup including EREV powertrains, resulted in an 87% sales increase. Changan’s planned entry into the European market signals its ambition to become a global player in the EV sector, potentially bringing more competition to the race for the best EVs.

Hyundai Motor Company saw flat sales overall, with Kia slightly outperforming Hyundai. The Kia EV9, launched in 2023, recorded approximately 19,000 sales in the first half of 2024. Declining sales in Europe and South Korea were offset by growth in the US. Hyundai and Kia’s ability to adapt to regional market conditions and introduce compelling new models like the EV9 will be crucial for their continued relevance in the quest for the best EVs.

Li Auto, specializing in large range-extender SUVs, continued its sales growth, driven by the launch of the L6 and increasing sales in Russia. Li Auto’s focus on range and larger SUV formats caters to specific consumer preferences and demonstrates the diversity within the EV market, offering a different perspective on what constitutes the “best EV” for certain buyers.

Challenges and Shifting Landscapes

GAC Aion faced momentum loss due to an aging model lineup, while Mercedes-Benz’s growth was hampered by losses in China and the phase-out of proprietary Smart models. These examples highlight the importance of continuous innovation and adapting to evolving market demands to remain competitive in the fast-paced EV sector.

Seres experienced a remarkable 515% sales growth, driven by Aito’s new large SUVs featuring EREV technology, the M7 and M9. Aito’s success mirrors Li Auto’s, focusing on large EREV SUVs, indicating a growing segment within the broader EV market and offering alternatives for those seeking range and size in their “best EV” considerations.

Toyota, despite being the world’s largest vehicle OEM, saw EVs constitute only about 3% of its total sales, although they did record healthy year-on-year growth in EV sales. Toyota’s gradual entry into the EV market reflects a more cautious approach, but their eventual expansion will undoubtedly impact the competitive landscape and the definition of “best EVs” across different categories.

SAIC’s growth fell below expectations, despite exporting a significant portion of its volume. Renault-Nissan-Mitsubishi Alliance faced difficulties, with weak EV sales in Japan and the discontinuation of the Renault Zoe in Europe impacting their performance. Incentive changes, such as the removal of purchase incentives for the Dacia Spring in France due to its Chinese production, also highlight the influence of policy on EV sales and market dynamics.

Dongfeng, a major state-owned OEM, recorded healthy EV sales growth across its nine brands, although its EV branch appears less developed compared to its ICE car and truck divisions. Ford saw only 4% of its global sales from EVs, indicating room for growth in its electric transition. Nio, Leapmotor, and XPeng all experienced healthy growth, but sales volumes remain below the viability threshold for large-scale profitability, as they continue to strive to establish themselves as providers of some of the best EVs in the premium segment.

Leading EV Models and the Road Ahead

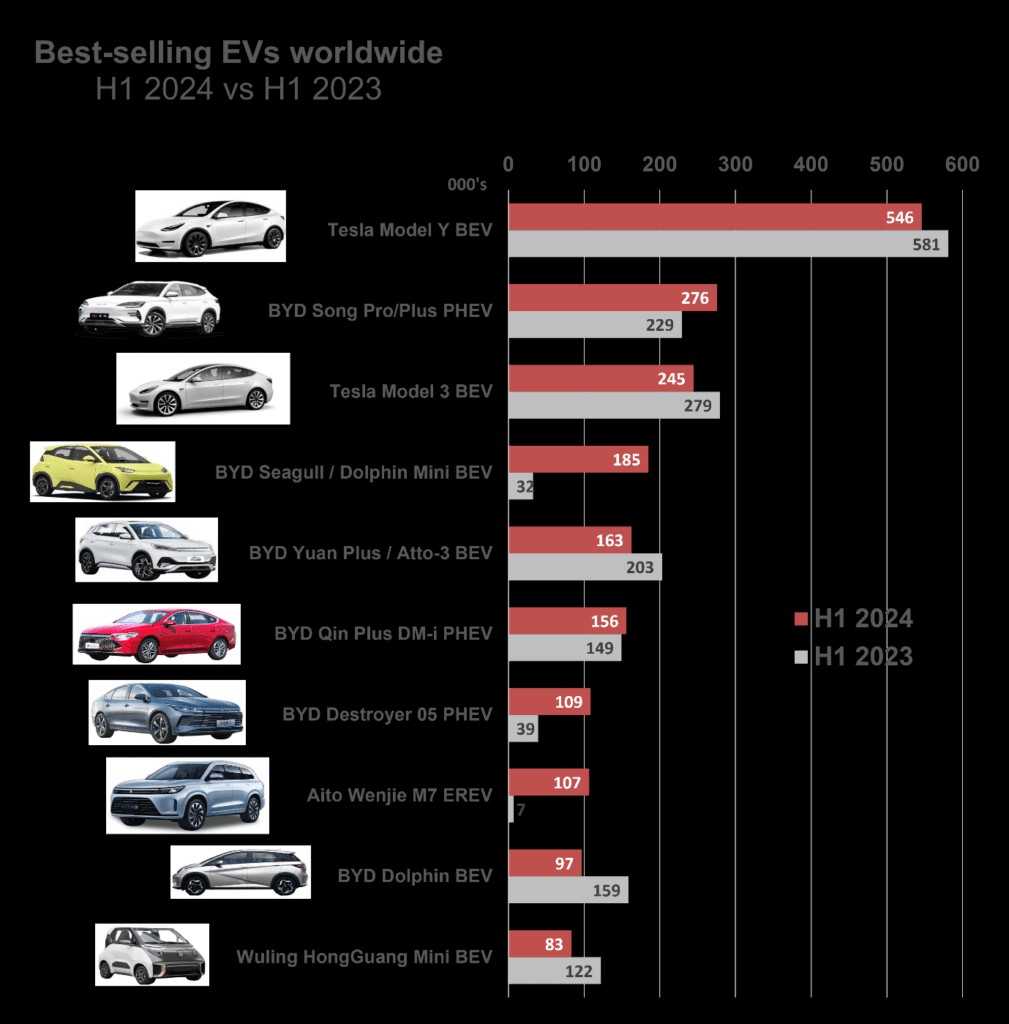

Tesla’s Model Y emerged as the world’s best-selling vehicle across all categories, including ICE vehicles, in the first half of 2024. However, its figures were down in Europe, partly due to increased competition from models like the Volvo EX30, BMW iX1 and iX2, and Hyundai Kona. These smaller, yet compelling, alternatives suggest a diversifying consumer preference within the EV market, challenging the notion of a single “best EV” and highlighting the rise of excellent EVs in various sizes and price points.

Top Selling EVs Globally

Top Selling EVs Globally

The BYD Song PHEV was the second-best-selling EV worldwide, and the second-best-selling vehicle in China, showcasing the popularity of PHEVs and BYD’s strong position in this segment. The Tesla Model 3 and BYD Seagull (Dolphin Mini) also ranked among the top-selling EVs, demonstrating the continued dominance of Tesla and BYD in the global EV market and their offerings as strong contenders for the title of “Best Ev On The Market” in their respective classes.

The BYD Qin Plus DM-I and Destroyer 05 PHEV further solidified BYD’s leading position, particularly in China’s midsize sedan segment. Aito’s Wenjie M7 and BYD Dolphin also featured among the top sellers, indicating the diverse range of models and manufacturers contributing to the expanding EV market.

While the Hongguang Mini EV’s sales declined from its peak, new entrants like the Changan Lumin and Geely Panda are emerging in the mini-car segment, suggesting continued demand for affordable urban EVs, contributing to the breadth of options for those seeking the “best ev” for city driving.

As we look towards the remainder of 2024, the EV market remains dynamic and competitive. The question of which models and manufacturers will ultimately claim the EV-sales crown and offer the “best ev on the market” is still open. Continued innovation, strategic adaptations to regional market conditions, and evolving consumer preferences will shape the future of the EV landscape. Stay tuned for further data-driven insights from EV Volumes on Autovista24 to keep abreast of the latest developments in this exciting and rapidly evolving industry.

Tech Electric Vehicles