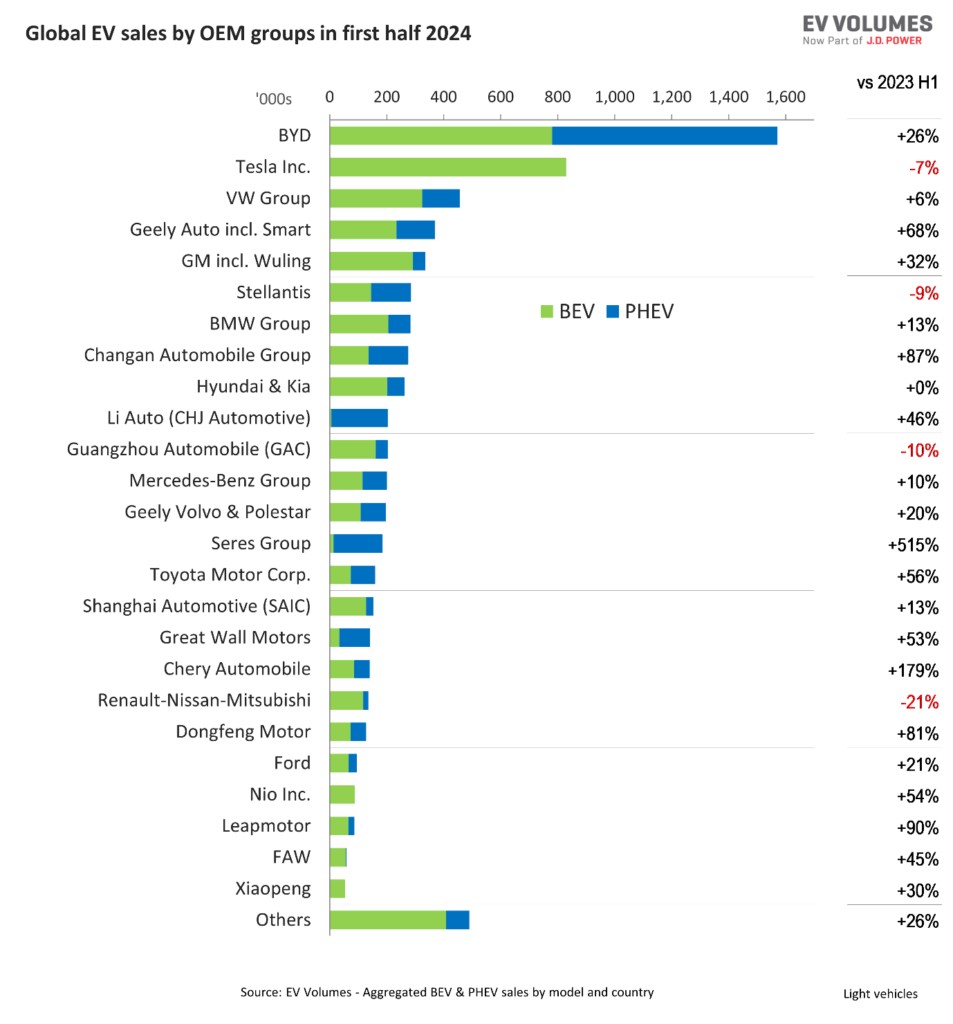

The global electric vehicle (EV) market in the first half of 2024 presented a landscape of varied successes and shifts, highlighting the dynamic nature of the industry. While some manufacturers surged ahead, leveraging regional growth and innovative models, others faced headwinds in an increasingly competitive environment. This mid-year review, drawing insights from EV Volumes, delves into which EV makers and models are leading the charge in 2024, providing a crucial overview for anyone tracking the pulse of the electric automotive world.

One of the most striking trends in the first six months of 2024 was the robust growth of Chinese EV manufacturers. Against a backdrop of more modest progress from many Western OEMs, brands like Geely, Changan, Li Auto, Seres (Aito), and Chery demonstrated remarkable expansion. This surge underscores the increasing dominance of China in the global EV market, driven by both domestic demand and growing export ambitions.

BYD, while experiencing a slowdown in its year-over-year volume growth to 26% compared to a previous 62% surge, maintained its position as the global EV market leader. With an extensive portfolio of 37 models, encompassing battery-electric vehicles (BEVs), plug-in hybrids (PHEVs), and extended-range electric vehicles (EREVs), BYD’s broad market presence is undeniable. However, the company is still developing its reach across all vehicle segments and is a relative newcomer to the EREV category.

Global Light Vehicle Market Share H1 2024

Global Light Vehicle Market Share H1 2024

Global light vehicle market share for the first half of 2024, showing top EV manufacturers and their respective percentages in the global market. Source: EV Volumes.

Despite being China’s largest OEM by production and sales, BYD’s international footprint is still evolving. While selling approximately 161,000 vehicles outside China, only about 17,000 found homes in Western and Central Europe. South America, ASEAN countries, the Middle East, and Russia emerged as BYD’s strongest export regions, accounting for a combined 114,000 units. This geographical sales distribution highlights the regional strengths and potential areas for expansion for BYD in the global market.

Tesla’s Market Position and Challenges

Tesla continued to lead in global BEV sales in the first half of 2024, albeit with a narrower lead than before. A 7% year-on-year decline in deliveries marked a first for the company during this period. Sales volumes decreased across key markets, including China, Western Europe, North America, Australia, and New Zealand, indicating growing pressures on Tesla’s global dominance.

The electric car pioneer is facing intense pricing competition, particularly in China, and rollout delays for its refreshed Model 3. Furthermore, certain Model 3 variants initially did not qualify for US Inflation Reduction Act (IRA) grants due to battery sourcing, adding complexity to its market strategy. Tesla’s monthly sales fluctuations also suggest strategic adjustments in logistics and supply chains, possibly aimed at optimizing grant eligibility and navigating tariff complexities.

Volkswagen (VW) Group also experienced a softening grip on the global EV market in the first half of the year. A 6% year-on-year sales growth lagged behind the overall global EV market expansion of 22%. While Audi and Cupra brands within the group showed growth, other brands experienced declines, pointing to a mixed performance across VW’s portfolio. In China, the VW brand is actively participating in price wars, while Audi and Porsche are not, and Cupra is not present, demonstrating regionally tailored brand strategies.

Geely’s Ascendancy in the EV Sector

Geely emerged as a significant gainer in the first half of 2024, tripling its global EV sector share. Its Chinese brands witnessed a substantial 68% year-on-year sales increase. Volvo, Geely’s European subsidiary, also outperformed the relatively stagnant European EV market, where it primarily sells its electric models. The Volvo EX30 BEV, a new entrant, quickly became popular, with around 45,000 units sold in the first half, approximately 39,000 of which were in Europe.

Geely’s export strategy, including brands like Volvo, Polestar, and Smart, saw roughly 118,000 units exported from China in the first half of 2024, with about 98,000 destined for Europe. A significant portion of these European sales, around 93,000 units, were China-made models from Volvo, Polestar, Smart, and Lotus. However, potential import tariffs on Chinese EV exports to Europe could constrain this growth, unless tariff exemptions are secured or production is relocated to Europe.

GM’s sales grew by 32% in the first half of 2024, outpacing the growth rate from the same period last year. New models based on the Ultium battery platform are gaining traction in the US market. In China, the Buick Velite 6 BEV achieved record sales for Buick in the region, with approximately 33,000 units sold. However, the phase-out of the Chevy Bolt, including its EUV variant, impacted overall growth. Much of GM’s recent growth can be attributed to its Chinese affiliate, Wuling, whose expanded portfolio, featuring models like the Wuling Bingo and Starlight PHEV, is offsetting declining sales of the Hongguang Mini-EV.

Market Stagnation and Brand Performance

Stellantis experienced a 9% decline in EV deliveries, largely due to its significant exposure to Europe’s sluggish EV market. Subsidy reductions in Europe have particularly affected sales of lower-priced EVs, a crucial segment for Stellantis. European deliveries fell by 20%, while sales of Jeep, Dodge, and Chrysler models in the US and Canada rose by 35%, showcasing regional market disparities.

BMW Group reported a 13% increase in EV sales in the first half of 2024. While Mini faced substantial year-on-year losses of 46%, the BMW brand itself achieved a solid 20% gain, particularly in Europe, where it became the second-largest EV seller in the first half.

Changan has successfully launched three new brands – Avatr, Deepal, and Qiyuan (Nevo) – in the past two years. With 12 models ranging from entry-premium upwards, including EREV powertrains, Changan’s sales surged by 87% in the first half, surpassing the 60% growth from the same period last year. The company is also planning to expand into the European market.

Hyundai Motor Company’s sales remained flat in the first half, although Kia showed slight gains over Hyundai. The Kia EV9, launched in the summer of 2023, recorded around 19,000 sales in the first six months of 2024. Sales of Kia Bongo and Hyundai Porter LCVs were impacted by the end of electric LCV grants in South Korea, resulting in a loss of approximately 17,500 sales. Declining sales in Europe and South Korea were balanced by growth in the US, while China saw modest sales of the Kia EV5.

Li Auto, known for its range-extender SUVs, continued its sales growth trajectory in the first half. Driven by the launch of the L6 and increased sales in Russia, the company achieved 14,400 unit sales.

GAC Aion brands experienced a slowdown, attributed to an aging model lineup. Mercedes-Benz’s growth was hampered by volume losses in China and the phase-out of proprietary Smart models. Seres, however, saw a remarkable 515% sales growth compared to a weak first half of 2023, primarily driven by its Aito brand’s new large SUVs, the M7 and M9, featuring EREV technology, positioning Aito as a potential competitor to Li Auto.

Toyota, despite being the world’s largest vehicle OEM, saw EVs constitute only about 3% of its total sales, although it did record healthy year-on-year EV growth. SAIC’s growth fell below expectations, despite exporting 58% of its EV volume, roughly 89,000 units, with about 56,000 sold in Europe, slightly behind the first half of 2023. Chery’s sales increased with new premium models, but its broader EV export ambitions are yet to fully materialize.

The Renault-Nissan-Mitsubishi Alliance faced challenges, with weak EV sales in Japan following the discontinuation of the Renault Zoe before replacements were available. The Dacia Spring, impacted by the removal of purchase incentives in France due to its China production, saw an 80% sales drop in France, representing about 12,000 units. Dongfeng recorded 127,400 EV sales across its brands, showing healthy growth, though its EV branch appears less dynamic compared to its ICE vehicle business. Ford’s EVs accounted for only 4% of its total global sales. Nio, Leapmotor, and XPeng all showed healthy growth but remained below the 400,000 annual sales viability threshold.

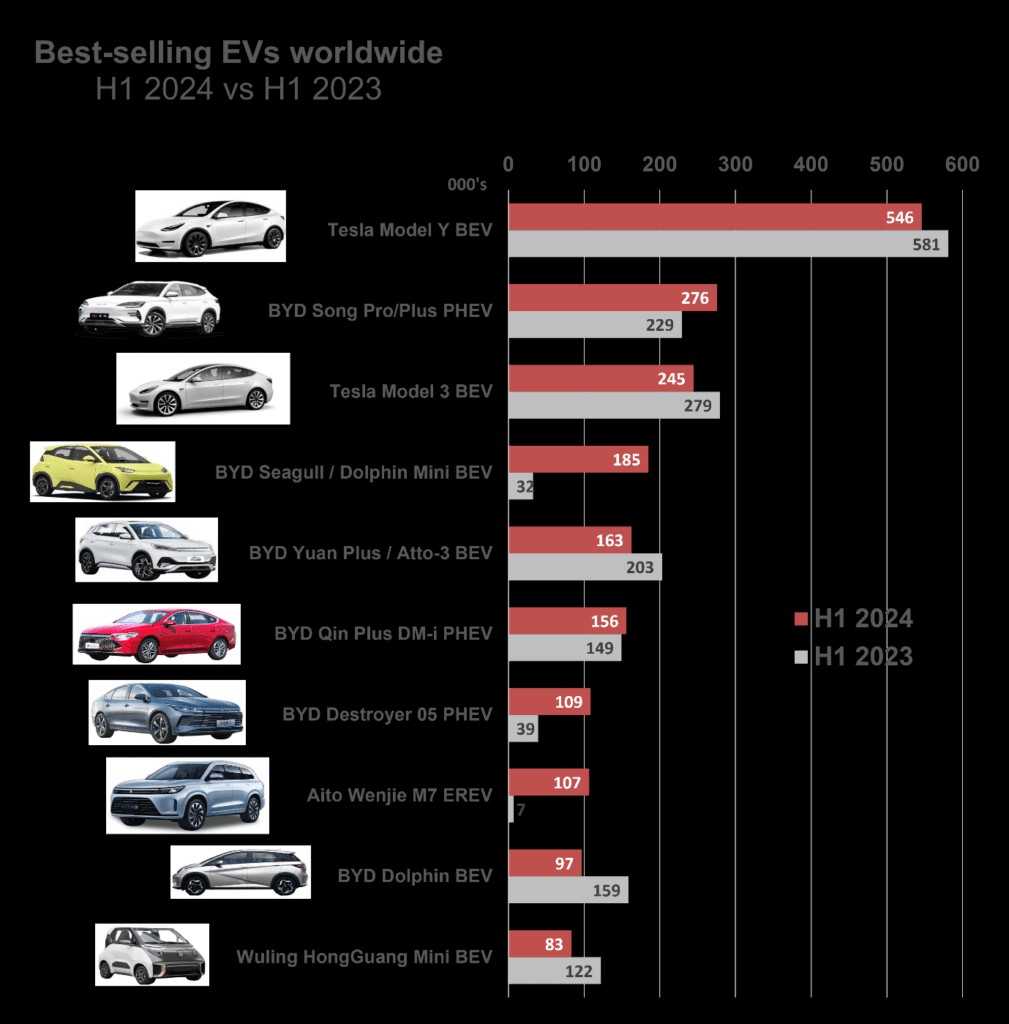

Leading EV Models of H1 2024

Tesla and BYD models dominated global EV sales in the first half of 2024. The Tesla Model Y emerged as the world’s best-selling vehicle across all categories, including ICE vehicles, although sales were down year-on-year, particularly in Europe. Increased competition in the BEV market, including models like the Volvo EX30, BMW iX1 and iX2, and Hyundai Kona, contributed to this shift, offering alternatives for buyers prioritizing size and price. A refreshed Model Y, codenamed Juniper, is anticipated, mirroring the improvements seen in the Model 3 refresh.

Top Selling BEV and PHEV Models Worldwide H1 2024

Top Selling BEV and PHEV Models Worldwide H1 2024

Top selling BEV and PHEV models worldwide during the first half of 2024, highlighting model performance and market leadership. Source: EV Volumes.

The BYD Song PHEV was not only the second best-selling vehicle in China but also globally among EVs. Its refreshed model saw sales increase in the first half of 2024, driven by its DM-i PHEV technology and competitive pricing. Tesla Model 3 deliveries fell by 12% in the first half, impacted by supply constraints in the US and IRA grant ineligibility for certain variants. However, Model 3 sales grew by 41% in Europe, while dropping in China and the US, suggesting strategic prioritization of European deliveries ahead of tariff changes.

The BYD Seagull BEV, or Dolphin Mini in export markets, became BYD’s smallest and most affordable model, undercutting the BYD Dolphin and affecting its sales. The BYD Yuan Plus BEV (Atto 3 in export markets) saw a 20% sales decline but continued to lead the compact SUV segment in China, facing increased competition and market shifts towards larger SUVs and EREV variants.

BYD’s Qin Plus DM-I, along with the Destroyer 05 PHEV, were top sellers in China’s midsize-sedan segment. The Aito Wenjie M7, a large SUV from Seres, similar to Li Auto’s models, also gained traction with its EREV technology. The BYD Dolphin experienced sales losses to the Seagull, while the Hongguang Mini EV continued its decline from previous peaks due to new competition and buyer upgrades.

Looking Ahead in the EV Race

As we move into the second half of 2024, the EV market remains dynamic and competitive. The trends from the first half indicate a shifting landscape where Chinese manufacturers are gaining prominence, Tesla is facing increased competition, and various market factors are influencing regional performance. The race to capture the EV sales crown in 2024 is far from over, and the evolving strategies of these leading manufacturers will be crucial in determining the final outcome. For further in-depth analysis and up-to-date data, resources like EV Volumes will be essential for staying informed about the ever-changing world of electric vehicles.

This article is based on a review of the EV market in the first half of 2024, drawing data and insights from EV Volumes and Autovista24.