Buying a new car is an exciting experience, and ensuring it’s properly insured is a crucial step in protecting your investment and peace of mind. Many car buyers wonder if insuring a new car differs from insuring a used one. For the most part, the types of insurance coverage you need for a new car are similar to those for any vehicle. However, certain factors and additional options become particularly relevant when you buy new. Understanding these nuances can help you make informed decisions about your new car insurance policy.

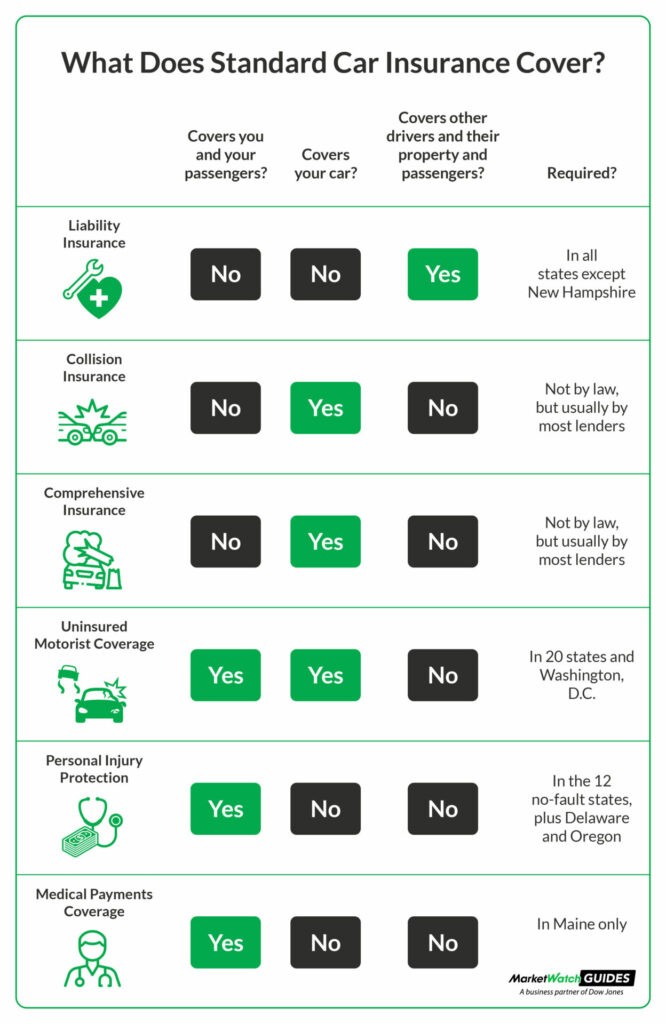

Standard Car Insurance Coverage Types Explained: Liability, Collision, Comprehensive, Uninsured Motorist, PIP, Medical Payments

Standard Car Insurance Coverage Types Explained: Liability, Collision, Comprehensive, Uninsured Motorist, PIP, Medical Payments

Standard Car Insurance for New Vehicles

Just like any car, your new car will require you to meet your state’s minimum car insurance requirements. These requirements, set by your state’s Department of Motor Vehicles (DMV) or equivalent agency, specify the minimum levels of coverage you must carry. These typically include some combination of standard auto insurance coverages.

Common types of required new car insurance coverage often include:

- Liability Coverage: This is almost always a minimum requirement and covers damages you cause to others and their property in an accident where you are at fault.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who either has no insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These cover medical expenses for you and your passengers, regardless of who is at fault in an accident.

Lender Requirements for New Car Insurance

If you finance your new car with a loan, your lender will likely have specific new car insurance requirements to protect their financial interest in the vehicle. These lender-mandated coverages are in addition to your state’s minimums and often include:

- Collision Coverage: This covers damage to your new car from collisions with other vehicles or objects, regardless of fault.

- Comprehensive Coverage: This protects your new car from other types of damage, such as theft, vandalism, weather events, and natural disasters.

Lenders require these coverages because a new car represents a significant financial asset for them until the loan is fully repaid.

Additional New Car Insurance Coverage Options

Beyond the standard and lender-required coverages, several optional new car insurance add-ons can provide extra security and convenience for new car owners. These options can enhance your overall protection and address specific concerns related to new vehicle ownership:

- Roadside Assistance: Essential for peace of mind, this coverage helps with services like towing, jump-starts, fuel delivery, and tire changes if you experience a breakdown.

- Rental Reimbursement: If your new car is in the shop for repairs after a covered accident, this coverage helps pay for a rental car, keeping you mobile.

- Mechanical Breakdown Insurance (MBI): Similar to an extended warranty, MBI covers repairs for mechanical failures that occur after the manufacturer’s warranty expires.

- Rideshare Insurance: If you plan to use your new car for ridesharing services like Uber or Lyft, this specialized coverage fills gaps in standard personal auto policies while you are working.

- Travel Expenses Coverage: If you are away from home and your new car is disabled due to a covered loss, this coverage can help with expenses like lodging and meals.

Choosing the right insurance when you buy a new car involves understanding both the essential coverages and the optional add-ons that fit your needs and circumstances. Consulting with a qualified insurance agent can provide personalized advice and ensure your new car is adequately protected.