For many new car owners, understanding car insurance can feel like navigating a maze. You might wonder, “Do new cars need special or different insurance compared to older vehicles?” The simple answer is generally no. The fundamental types of car insurance coverage remain consistent regardless of whether your car is fresh off the lot or has seen a few years on the road. However, the specifics of your situation, such as your location and whether you’re financing your purchase, will significantly influence the car insurance you need when buying a new car.

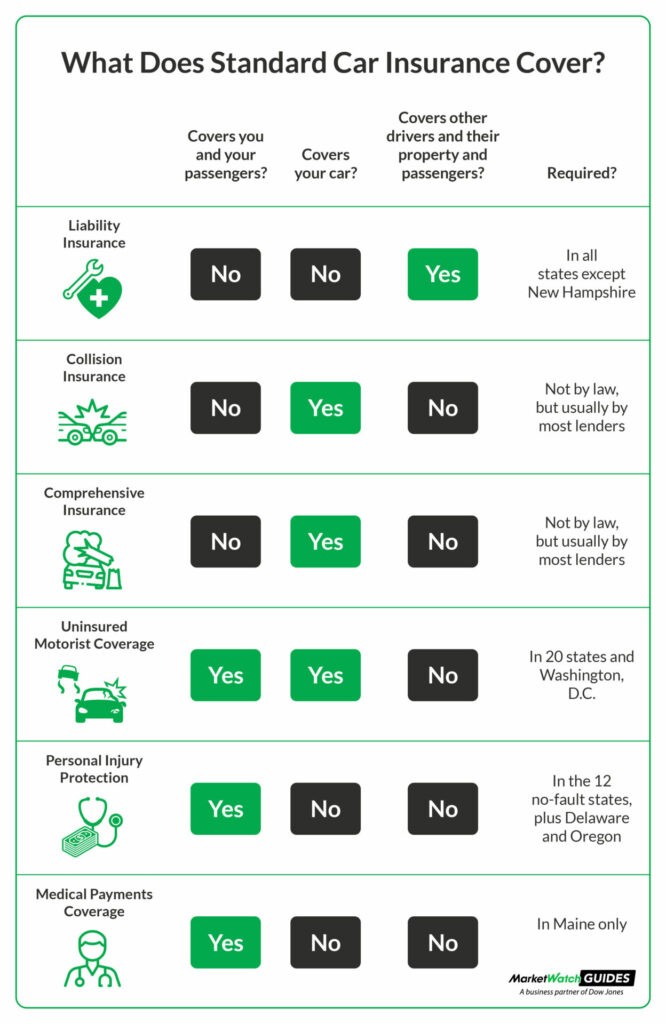

A table outlining six standard car insurance coverages and their protections, essential knowledge for car insurance when buying a new car.

A table outlining six standard car insurance coverages and their protections, essential knowledge for car insurance when buying a new car.

Understanding Standard Car Insurance Coverage for Your New Vehicle

Each state sets its own minimum car insurance requirements, typically managed by the Department of Motor Vehicles (DMV) or a similar state agency. These regulations can vary considerably from state to state, making it crucial to understand the mandates where you reside. To find the specific requirements for your state and explore recommended providers offering competitive rates, resources are available online to guide you.

These state minimums usually consist of variations of standard auto insurance coverages. When considering Car Insurance When Buying A New Car, familiarity with these standard types is essential:

- Liability Insurance: This is the cornerstone of car insurance and is legally required in most states. It covers damages and injuries you cause to others in an accident where you are at fault. Liability coverage typically includes two components: bodily injury liability (covering medical expenses and lost wages of injured parties) and property damage liability (covering damage to other vehicles or property).

- Collision Coverage: This coverage protects your new car from damage resulting from a collision with another vehicle or object, regardless of who is at fault. Whether you back into a pole or are involved in a multi-car pileup, collision coverage can help pay for repairs to your vehicle.

- Comprehensive Coverage: Often paired with collision coverage, comprehensive insurance covers damages to your new car from non-collision events. This includes incidents like theft, vandalism, fire, hail, animal damage, and natural disasters. If your new car is damaged by a falling tree or stolen from your driveway, comprehensive coverage can step in.

- Uninsured and Underinsured Motorist Coverage: This protects you if you’re hit by a driver who either has no insurance (uninsured) or insufficient insurance to cover your damages (underinsured). Given that not all drivers carry adequate insurance, this coverage is vital for financial protection, particularly when considering car insurance when buying a new car.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): These coverages help pay for medical expenses for you and your passengers if you’re injured in a car accident, regardless of fault. PIP can also extend to lost wages and other related expenses, depending on your state’s regulations. MedPay and PIP can provide immediate financial relief after an accident.

Lender Requirements for New Car Insurance Policies

If you finance your new car through a loan or lease, your lender will likely have specific car insurance requirements beyond state minimums. These additional requirements are in place to protect their financial interest in the vehicle. Until you’ve paid off the loan, the lender technically has a financial stake in your new car.

Lenders commonly mandate that you carry both collision and comprehensive coverage. This ensures that the car is protected against damage from accidents or other incidents that could diminish its value. By requiring these coverages, lenders mitigate their risk of losing money if the car is totaled or significantly damaged before the loan is repaid. Therefore, when exploring car insurance when buying a new car with financing, factor in these lender-required coverages.

Additional Car Insurance Options for New Car Owners

Beyond the standard and lender-required coverages, numerous optional add-ons can enhance your car insurance policy and provide extra peace of mind with your new vehicle. These options cater to various aspects of new car ownership and potential emergencies:

- Roadside Assistance: A very popular and practical option, roadside assistance covers services like towing, jump-starts, fuel delivery if you run out of gas, and flat tire changes. This coverage can be invaluable if you experience a breakdown, especially in a new car where unexpected issues can still occur.

- Rental Reimbursement: If your new car is in the shop for repairs due to a covered accident, rental reimbursement coverage helps pay for the cost of a rental car, keeping you mobile while your vehicle is being fixed. This can be a significant benefit, preventing disruption to your daily routine.

- Mechanical Breakdown Insurance (MBI): MBI is similar to an extended car warranty but is offered by insurance companies. It covers repairs to certain mechanical components of your car after a breakdown, often after the manufacturer’s warranty expires. For new cars, MBI can provide longer-term protection against unexpected repair bills.

- Rideshare Insurance: If you plan to use your new car for ridesharing services like Uber or Lyft, standard personal car insurance policies typically exclude coverage during the time you are driving for these services. Rideshare insurance bridges this gap, providing coverage during downtime between passenger pickups.

- Travel Expenses Coverage: If you experience a covered loss while away from home and your new car becomes unusable, travel expenses coverage can reimburse you for costs like food, lodging, and alternative transportation. This can be beneficial for road trips or situations where you rely on your car for travel.

The array of optional car insurance coverages available can vary among insurance providers. To fully understand the available options and determine the best car insurance when buying a new car for your needs, it’s advisable to speak with an insurance agent. They can provide personalized advice and help you tailor a policy that offers comprehensive protection and fits your budget.