Car insurance costs can vary wildly, and for many car owners, finding the cheapest rates is a top priority. While your driving record and location play significant roles, the type of car you drive is also a major factor in determining your insurance premiums. If you’re looking to save money on your auto insurance, choosing one of the cheapest cars to insure is a smart move.

At cardiagnosticnearme.com, we understand the importance of managing car ownership costs. As experts in auto repair and vehicle diagnostics, we know firsthand how different vehicles can impact your wallet, not just at the repair shop, but also when it comes to insurance. Our team has analyzed the latest data to bring you insights into the cars that offer the most affordable insurance rates in 2024. We’ll break down the cheapest car brands, models, and vehicle types to insure, and explain the key factors that influence these costs. Whether you’re buying a new car or simply looking to lower your current insurance bill, this guide will help you navigate the world of cheap car insurance.

Compare Car Insurance Rates

Get matched with a top provider and compare instant quotes in just a few clicks

With one of our trusted comparison partners

Cheapest Car Brands for Insurance

Our research indicates that when it comes to brand affordability for insurance, Subaru consistently ranks as the cheapest car brand to insure. For drivers seeking budget-friendly coverage, Subaru stands out. Following closely behind Subaru are Ford, Honda, and Toyota, all known for their reliability and reasonable insurance costs.

To give you a clearer picture, here’s a comparison of average annual and monthly full-coverage insurance costs for ten popular automakers:

| Automaker | Annual Full-Coverage Cost | Monthly Full-Coverage Cost |

|---|---|---|

| 1. Subaru | $2,224 | $185 |

| 2. Ford | $2,299 | $192 |

| 3. Honda | $2,395 | $200 |

| 4. Toyota | $2,456 | $205 |

| 5. Chevrolet | $2,513 | $209 |

| 6. Nissan | $2,603 | $217 |

| 7. Hyundai | $2,625 | $219 |

| 8. Kia | $2,721 | $227 |

| 9. GMC | $3,062 | $255 |

| 10. Tesla | $4,098 | $342 |

Page 1 of

This table clearly shows Subaru leading the pack as the cheapest brand for car insurance, while Tesla sits at the other end of the spectrum as the most expensive among these popular brands.

Top Car Models with the Lowest Insurance Rates

While brand averages are helpful, drilling down to specific models provides even more actionable information. Below is a list of 32 car models, ranked from the cheapest to the most expensive to insure in 2024. These rates are based on full-coverage policies for a 35-year-old driver with a clean driving record and good credit score.

| Vehicle Model | Annual Full-Coverage Cost | Monthly Full-Coverage Cost |

|---|---|---|

| 2021 Ford Bronco | $2,192 | $183 |

| 2021 Subaru Crosstrek | $2,214 | $185 |

| 2021 Honda CRV Hybrid | $2,223 | $185 |

| 2021 Subaru Impreza | $2,233 | $186 |

| 2021 Chevy Equinox | $2,253 | $188 |

| 2021 Ford Escape Hybrid | $2,266 | $189 |

| 2021 Kia Sportage | $2,298 | $192 |

| 2021 Toyota Rav4 | $2,325 | $194 |

| 2021 Nissan Frontier | $2,396 | $200 |

| 2021 GMC Sierra | $2,418 | $202 |

| 2021 Ford F150 | $2,438 | $203 |

| 2021 Honda Ridgeline | $2,455 | $205 |

| 2021 Chevy Silverado | $2,458 | $205 |

| 2021 Toyota Tacoma | $2,460 | $205 |

| 2021 Hyundai Santa Fe | $2,486 | $207 |

| 2021 Honda Civic | $2,507 | $209 |

| 2021 Nissan Rogue | $2,517 | $210 |

| 2021 Nissan Leaf | $2,519 | $210 |

| 2021 GMC Acadia | $2,546 | $212 |

| 2021 Toyota Prius | $2,582 | $215 |

| 2021 Chevy Malibu | $2,602 | $217 |

| 2021 Hyundai Elantra | $2,681 | $223 |

| 2021 Hyundai Ioniq | $2,709 | $226 |

| 2024 Chevy Silverado EV | $2,740 | $228 |

| 2021 Kia Forte | $2,799 | $233 |

| 2021 Nissan Altima | $2,981 | $248 |

| 2022 Kia EV6 2022 | $3,067 | $256 |

| 2021 Tesla Model Y | $3,426 | $286 |

| 2021 Tesla Model 3 | $3,664 | $305 |

| 2022 GMC Hummer EV 2022 | $4,221 | $352 |

| 2021 Tesla Model X | $4,516 | $376 |

| 2021 Tesla Model S | $4,786 | $399 |

Page 1 of

The 2021 Ford Bronco tops this list as the cheapest car model to insure, followed by several Subaru and Honda models. Noticeably, electric vehicles and luxury models tend to be on the more expensive end of the spectrum.

Vehicle Types with the Most Affordable Insurance

Looking beyond specific makes and models, considering vehicle types can also guide your choice for cheaper insurance. Our analysis reveals that SUVs and hybrids are generally the most affordable vehicle types to insure.

| Vehicle Type | Annual Full-Coverage Cost | Monthly Full-Coverage Cost |

|---|---|---|

| SUV | $2,339 | $195 |

| Hybrid | $2,357 | $196 |

| Truck | $2,439 | $203 |

| Sedan | $2,635 | $220 |

| EV | $3,520 | $293 |

Page 1 of

SUVs and hybrids often benefit from lower insurance rates due to a combination of factors including their safety ratings and the driving habits of their owners. Conversely, electric vehicles (EVs) currently average the highest insurance costs among these vehicle types.

These vehicle types generally have characteristics that contribute to lower insurance premiums:

- Ease of Handling: Cars that are easy to drive and control are statistically less likely to be involved in accidents.

- Standard Parts and Repair: Vehicles with readily available and standard components tend to have lower repair costs, which translates to lower insurance premiums. As auto repair specialists, we at cardiagnosticnearme.com know that complex or rare parts often drive up repair bills, and insurers are aware of this.

- Strong Safety Ratings: Cars that perform well in safety tests indicate a lower risk of injury in accidents, making them less costly to insure.

- Lower Damage to Others: Vehicles designed to minimize damage to other vehicles in accidents can also reduce insurance payouts.

- Passenger Protection: Cars that offer robust protection to their occupants in crashes are viewed favorably by insurance companies.

Factors Influencing Car Insurance Costs for Different Cars

Numerous factors beyond just the car model itself determine your car insurance rates. These can be broadly categorized into vehicle factors, your coverage choices, and your personal driving profile. Understanding these elements is key to finding the cheapest insurance possible.

Vehicle-Related Factors

Even if you opt for a model known for cheap insurance, specific vehicle characteristics play a role:

- Vehicle Age: It’s a common misconception that older cars are always cheaper to insure. While liability coverage might be cheaper for older vehicles, newer cars often come equipped with advanced safety features that can lower premiums. However, the potentially higher cost of repairing newer, technologically complex vehicles can sometimes offset these savings.

- Vehicle Type: As seen in our vehicle type analysis, SUVs and minivans often have lower insurance rates. Sedans and larger SUVs tend to be moderately more expensive. Pick-up trucks, EVs, luxury cars, and sports cars are generally the most expensive to insure.

- Trim Level: The more luxurious your car’s trim level, the higher your insurance might be. Premium trims often include features that are more expensive to repair or replace.

- Safety Features: Vehicles with high safety ratings from organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) typically qualify for lower insurance rates. Features like airbags, anti-lock brakes, and advanced driver-assistance systems (ADAS) all contribute to savings.

- Theft Rates: Certain car models are more frequently targeted by thieves. Models with higher theft rates, as tracked by the National Insurance Crime Bureau (NICB), will likely have higher insurance costs due to the increased risk of claims.

Your Coverage Choices

Your decisions about insurance coverage directly impact your premiums:

- Coverage Level: Minimum liability coverage, mandated by most states, will always be cheaper than full-coverage insurance. However, minimum coverage offers less financial protection in case of an accident.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) will lower your monthly premiums. Conversely, a lower deductible means higher premiums but less out-of-pocket expense after an incident.

- Policy Bundling: Many insurers offer discounts when you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Annual Mileage: Driving less often can translate to lower insurance rates. Insurers often offer discounts to drivers with lower annual mileage as they are statistically less likely to be involved in accidents.

Personal Factors Affecting Your Insurance Rates

Your personal profile as a driver is a significant determinant of insurance costs, even for the cheapest cars to insure. Riskier driver profiles will always lead to higher premiums.

- Driving Record: A history of accidents, speeding tickets, or DUIs will significantly increase your insurance rates. Clean driving records are rewarded with the lowest premiums.

- Age, Gender, and Marital Status: Statistically, younger drivers, particularly young males, and single individuals are considered higher risk and often pay more for insurance.

- Credit Score: In many states, your credit score can impact your insurance rates. Lower credit scores are often correlated with higher risk, leading to increased premiums. Insurers view credit score as a predictor of claim frequency.

- Location: If you live in an area with high crime rates, a large number of uninsured drivers, or frequent accidents, you will likely pay more for car insurance. Urban areas generally have higher rates than rural areas.

Even with a car known for cheap insurance, factors like a poor driving record or low credit score can still result in higher-than-average premiums. Conversely, a safe driver with good credit can secure very affordable rates, especially on a cheap-to-insure vehicle.

Maximize Savings with Car Insurance Discounts

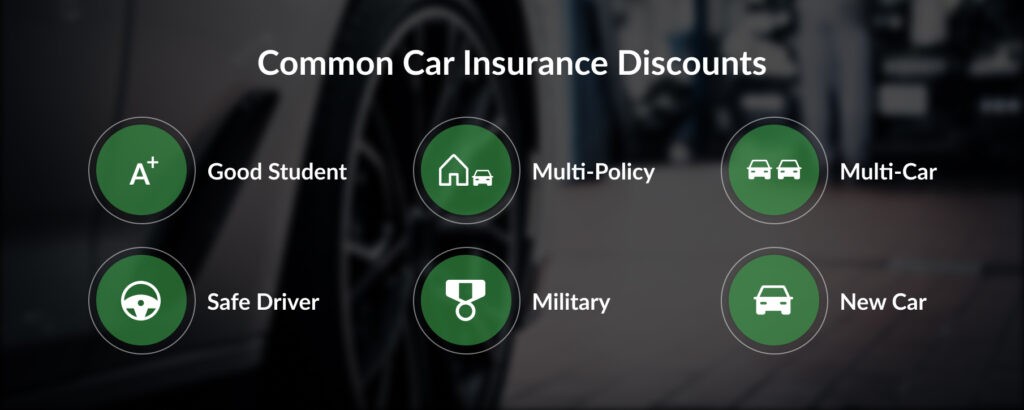

Taking advantage of available car insurance discounts is a powerful way to lower your premiums. Many insurance providers offer a range of discounts.

Infographic showing various car insurance discounts such as safe driver, good student, multi-vehicle, multi-policy, military, vehicle safety features, senior, and usage-based insurance discounts

Infographic showing various car insurance discounts such as safe driver, good student, multi-vehicle, multi-policy, military, vehicle safety features, senior, and usage-based insurance discounts

Here are some common car insurance discounts to explore:

| Car Insurance Discounts | Discount Details |

|---|---|

| Safe driver discount | Lower premiums for drivers accident-free for several years |

| Good student discount | Reduced rates for full-time students with a B average or higher |

| Multi-vehicle discount | Savings for insuring multiple cars under the same policy |

| Multi-policy discount | Discounts for bundling auto insurance with other insurance types |

| Military discount | Lower premiums for active-duty military personnel |

| Vehicle safety features discount | Discount for cars equipped with airbags, anti-lock brakes, anti-theft systems |

| Senior discount | Reduced rates for older drivers (typically 55+) , sometimes after completing a driving course |

| Usage-based insurance discount | Rates adjusted based on safe driving habits tracked by telematics |

Page 1 of

These are just some of the potential discounts available. Always inquire with your insurance provider about all possible discounts to maximize your savings.

Is Choosing the Cheapest Car to Insure the Right Decision?

While cost is a significant consideration, focusing solely on the cheapest car to insure might not be the best approach. Cars with the lowest insurance rates are often safe and reliable, but they may not meet everyone’s needs or preferences. Furthermore, extremely low insurance quotes should be approached with caution, as they might indicate inadequate coverage from a less reputable insurer.

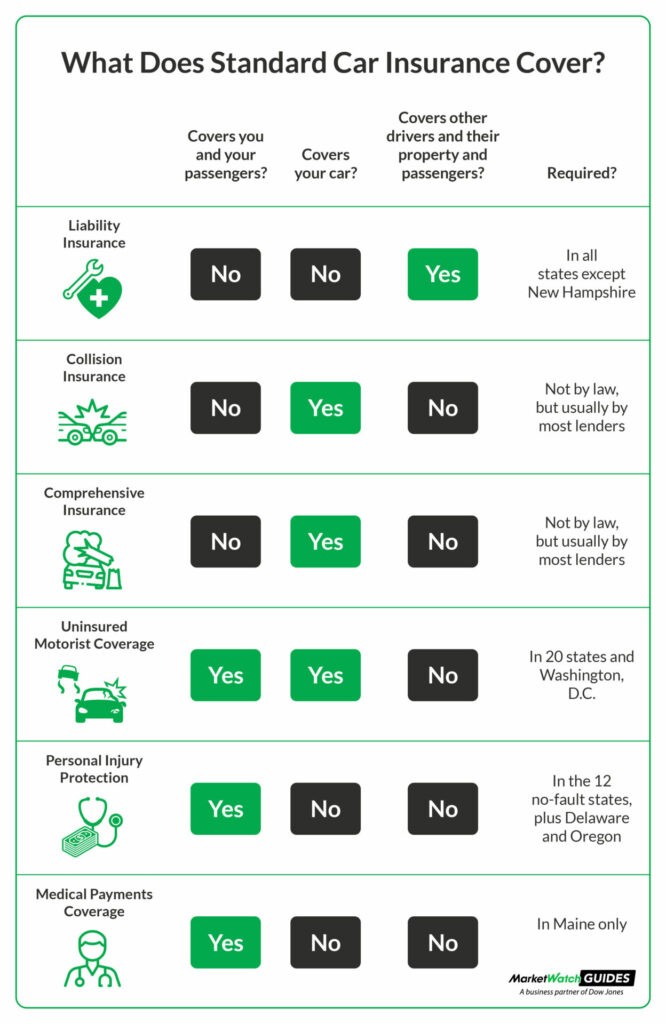

It’s crucial to balance cost with your individual needs and desired coverage levels. While opting for minimum coverage will reduce your premium, it also leaves you less protected financially in the event of an accident. Consider your risk tolerance and ensure you have sufficient coverage to protect yourself and your assets. Comprehensive and collision coverage, while adding to the cost, provide crucial protection against various risks, including damage to your own vehicle, regardless of fault.

Table explaining six standard types of car insurance coverage and their benefits

Table explaining six standard types of car insurance coverage and their benefits

Compare Car Insurance Rates

Get matched with a top provider and compare instant quotes in just a few clicks

With one of our trusted comparison partners

Frequently Asked Questions About Cars with Cheap Insurance

Here are answers to some common questions about finding affordable car insurance based on vehicle type:

What is the absolute cheapest car model to insure?

According to our data, the 2021 Ford Bronco is currently the cheapest car model to insure in 2024, with an average full-coverage cost of $2,192 annually or $183 per month. These rates are based on a 35-year-old driver with a good driving record and credit score.

Which car insurance company generally offers the cheapest rates?

Geico is often cited as one of the cheapest car insurance companies nationwide. However, rates are highly personalized, and the cheapest company for one driver might not be the cheapest for another. It’s essential to compare quotes from multiple insurers, including Geico, State Farm, USAA, and Progressive, to find your lowest rate.

Are newer cars always cheaper to insure?

Not necessarily. While newer cars often have advanced safety features that can lower insurance costs, the higher repair costs associated with complex technology and parts can sometimes make newer vehicles more expensive to insure than older, simpler models.

Are automatic cars cheaper to insure than manual cars?

No, automatic transmission cars are typically more expensive to insure than manual transmission vehicles. Automatic transmissions are generally more complex and costly to repair than manual transmissions, leading to slightly higher insurance premiums.

Does a cheaper car always mean cheaper insurance?

Generally, more expensive vehicles cost more to insure due to higher repair and replacement costs. However, a less expensive car isn’t always cheaper to insure. Factors like vehicle age, make, model, safety ratings, and theft rates all play a role, and sometimes a less expensive car can be pricier to insure based on these factors.

What kinds of cars are the most expensive to insure?

Luxury cars and vehicles with a higher likelihood of theft, accidents, or expensive claims are typically the most expensive to insure. This often includes high-performance sports cars, luxury SUVs, and certain electric vehicles with high repair costs.

Are SUVs or sedans cheaper to insure?

Our data indicates that SUVs are generally slightly cheaper to insure than sedans in 2024. This may be attributed to the enhanced safety and protective features often associated with larger SUV models.

Our Methodology

Car Insurance Methodology

At cardiagnosticnearme.com, we are committed to providing objective and accurate information. Our car insurance rankings are based on a comprehensive rating system that analyzes numerous factors across dozens of auto insurance providers. This methodology ensures that our recommendations are data-driven and reliable.

Factors considered in our ratings:

- Coverage Options (30% of total score): We prioritize companies offering a wide range of coverage choices to meet diverse consumer needs.

- Cost and Discounts (25% of total score): Our analysis incorporates rate estimates provided by Quadrant Information Services and evaluates the availability of various discount opportunities.

- Industry Standing (20% of total score): We assess market share, ratings from industry experts, and the company’s years in business to gauge industry strength and stability.

- Customer Experience (15% of total score): Customer satisfaction is evaluated using complaint data from the National Association of Insurance Commissioners (NAIC), J.D. Power customer satisfaction ratings, and our own shopper analysis assessing customer service responsiveness and helpfulness.

- Availability (10% of total score): We favor companies with broad state availability and minimal eligibility restrictions.

Our Credentials:

- 800+ hours of dedicated research

- 130+ companies thoroughly reviewed

- 8,500+ consumers surveyed to gather real-world insights

*Data accurate as of publication date.

For feedback or questions about this article, please contact our team at [email protected].