Buying a new car is an exciting experience, and ensuring you have the right insurance is a crucial step in protecting your new investment. Many new car buyers wonder if they need special or different types of car insurance compared to used vehicles. For the most part, the fundamental types of car insurance coverage remain the same, but understanding the nuances, especially when financing, is key.

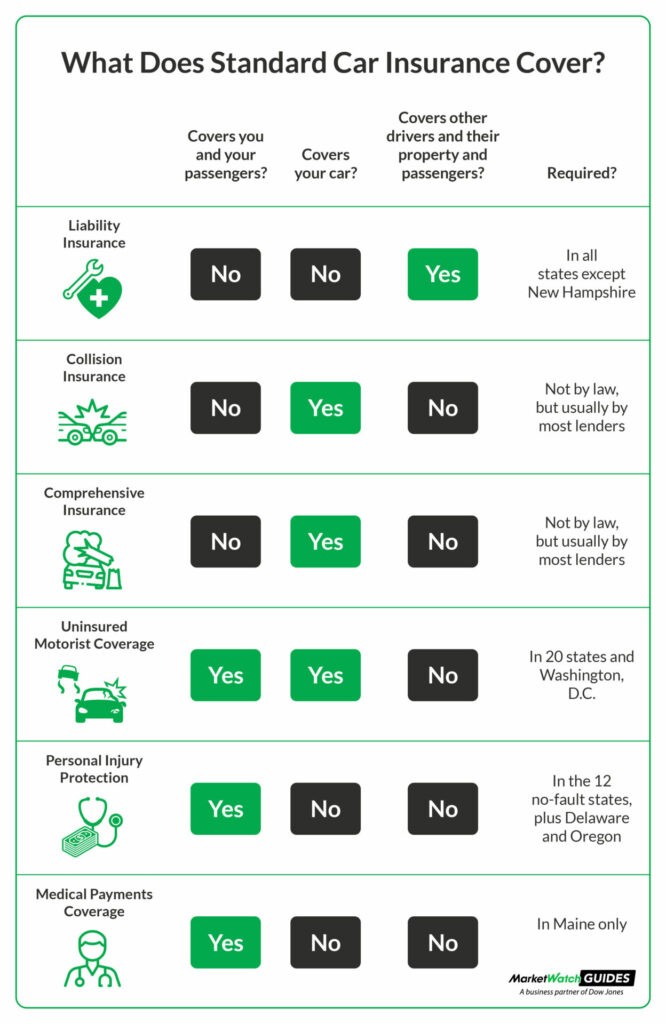

Understanding Car Insurance Coverage Types: A detailed table outlining six standard car insurance types including liability, collision, comprehensive, personal injury protection (PIP), uninsured/underinsured motorist, and medical payments, and what each covers, for new car owners.

Understanding Car Insurance Coverage Types: A detailed table outlining six standard car insurance types including liability, collision, comprehensive, personal injury protection (PIP), uninsured/underinsured motorist, and medical payments, and what each covers, for new car owners.

State Minimum Car Insurance Requirements

It’s essential to recognize that car insurance requirements are not uniform across the United States. Each state sets its own minimum coverage levels, typically managed by the Department of Motor Vehicles (DMV) or similar state agencies. These state-mandated minimums can vary significantly, impacting the level of financial protection you have in case of an accident. To find out the specific requirements for your location, it’s advisable to check directly with your state’s DMV or insurance regulator. Many resources online also provide state-by-state breakdowns of minimum car insurance obligations.

Standard Car Insurance Coverage for New Cars

State minimum requirements usually consist of a combination of core auto insurance coverages. These standard types of insurance are the building blocks of most car insurance policies, whether for a new or used vehicle:

- Liability Insurance: This is almost always a cornerstone of state-mandated minimums. It covers damages you cause to others and their property in an accident where you are at fault. Liability coverage typically includes both bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re in an accident caused by a driver who either has no insurance (uninsured) or insufficient insurance to cover your damages (underinsured).

- Collision Coverage: This coverage pays for damages to your vehicle resulting from a collision with another object or vehicle, regardless of who is at fault.

- Comprehensive Coverage: Often referred to as “other than collision” coverage, comprehensive insurance covers damages to your car from events outside of collisions, such as theft, vandalism, weather events (hail, flood), and animal damage.

Lender Requirements for New Car Insurance

If you finance your new car through a loan, your lender will likely have specific insurance requirements to protect their financial interest in the vehicle. Lenders want to ensure the car, their collateral, is protected against damage. Therefore, they commonly require you to carry:

- Collision Coverage: To protect the car from damage in accidents.

- Comprehensive Coverage: To safeguard against other forms of damage or loss, like theft or natural disasters.

Lenders may stipulate the minimum coverage levels for these two types, often requiring “full coverage,” which generally means carrying both collision and comprehensive with deductibles that meet their criteria.

Additional Car Insurance Options for New Vehicles

Beyond the standard and lender-required coverages, numerous optional add-ons can provide extra peace of mind and financial security, especially with a new car:

- Roadside Assistance: This coverage is invaluable for new car owners, covering services like towing, jump-starts, fuel delivery, and tire changes if you experience a breakdown.

- Rental Reimbursement: If your new car is damaged and in the repair shop due to a covered accident, rental reimbursement helps pay for a rental car, minimizing disruption to your daily life.

- Mechanical Breakdown Insurance (MBI): MBI is similar to an extended warranty and can cover repairs for mechanical failures not related to accidents, offering protection beyond the manufacturer’s warranty period.

- Rideshare Insurance: If you plan to use your new car for rideshare services like Uber or Lyft, rideshare insurance is essential to bridge coverage gaps between your personal policy and the rideshare company’s insurance.

- Travel Expenses Coverage: If you are away from home and your car becomes unusable due to a covered incident, this coverage can help with expenses like lodging and meals.

Understanding your insurance needs when buying a new car involves considering state mandates, lender stipulations if applicable, and your personal risk tolerance. Discussing these options with an insurance agent can help you tailor a policy that provides the right protection for your new vehicle and your financial well-being.