The California New Car Dealers Association (CNCDA) has released its Year End 2024 California Auto Outlook Report, offering key insights into the state’s automotive market. This report, based on data from Experian Automotive, reveals crucial shifts in consumer preferences and brand performance, which are highly relevant for understanding upcoming New Car Releases and market strategies.

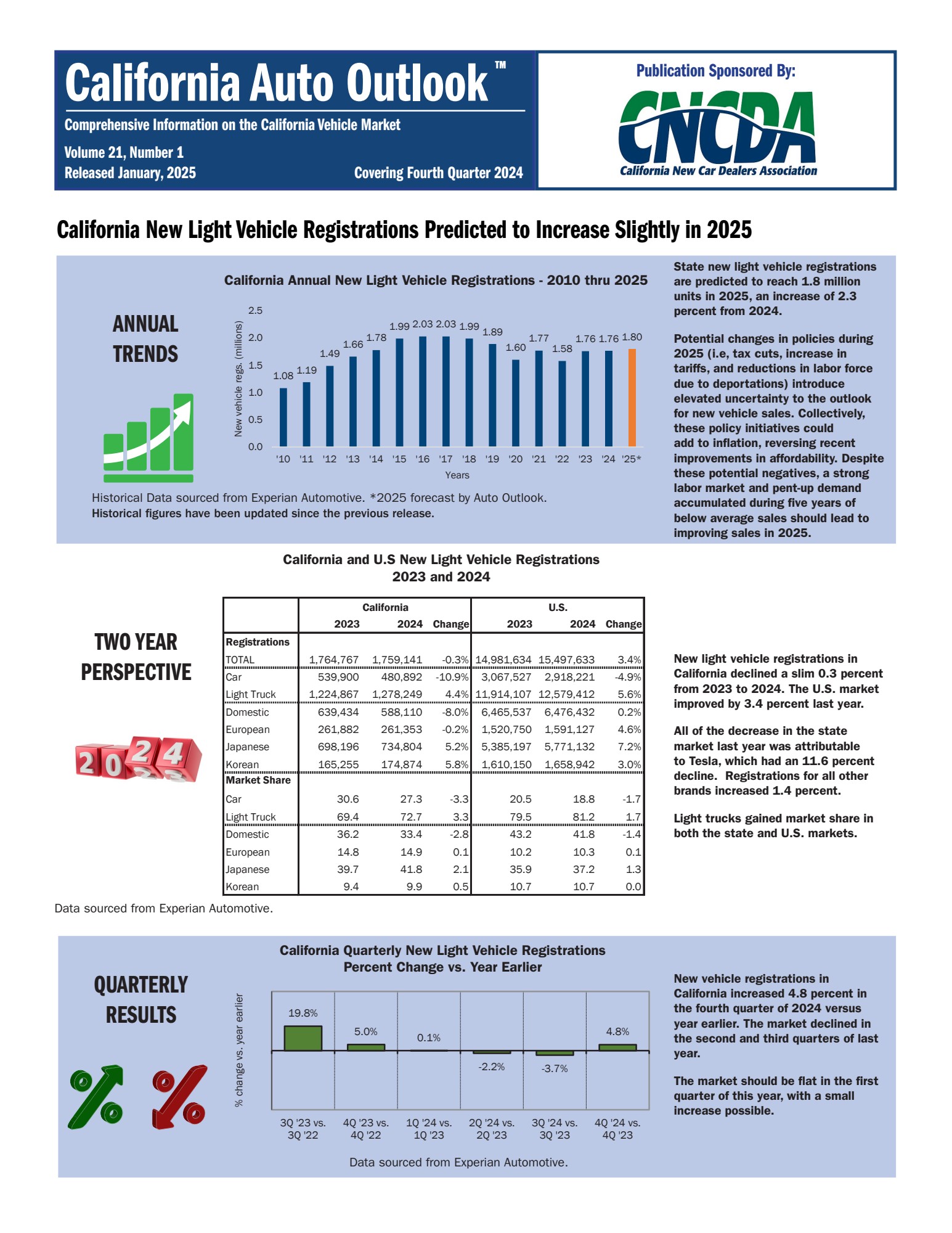

While overall new vehicle registrations in California remained relatively stable in 2024, with 1,759,141 light vehicles registered (a slight 0.3% decrease from 2023), the report highlights significant undercurrents, particularly in the electric vehicle (EV) sector and the rising popularity of hybrids. Projections for 2025 are positive, anticipating a slight increase to 1.80 million registrations, suggesting a healthy environment for new car releases in the coming year.

One of the most notable findings is Tesla’s declining dominance in the EV market. The report indicates Tesla’s fifth consecutive quarterly registration decline, with a 7.8% drop in Q4 2024 and an 11.6% overall decline for the year. Tesla’s market share in the Zero Emission Vehicle (ZEV) sector has also decreased by 7.6 points, although it still holds a significant 52.5% share. This shift could signal a more competitive landscape for new EV releases, with opportunities for other manufacturers to capture market share. For those interested in new car releases, this means a potentially wider array of EV options beyond Tesla in the near future.

Interestingly, while ZEV market share experienced a slight dip in Q4 2024, falling to 21.3% from 23.7% in Q3, hybrid vehicle registrations surged. Hybrids gained 2.4 percentage points in Q4, mirroring the ZEV decline. This trend suggests a growing consumer preference for hybrids as a transitional technology, bridging the gap between traditional internal combustion engines (ICE) and fully electric vehicles. This is a key indicator for manufacturers planning new car releases, suggesting strong consumer demand for hybrid models alongside EVs and traditional vehicles. The overall alternative powertrain sector, including ZEVs and hybrids, reached 40.2% market share for the year and 42.2% in Q4, demonstrating the significant impact of non-traditional powertrains on the new car market.

In terms of brand performance, Toyota continues to lead the California market with 289,258 registrations in 2024, a 4.4% increase from the previous year, capturing 16.4% market share. Tesla and Honda follow, with Honda experiencing an impressive 11.5% increase in registrations. Several brands, including Lincoln, Land Rover, Cadillac, and Buick, saw registration increases of 20% or more in 2024. These brand dynamics are crucial for understanding the competitive context for new car releases. Toyota’s continued dominance indicates the importance of reliability and brand trust, while the growth of other brands suggests evolving consumer preferences and successful new models entering the market.

Looking at model segment rankings, the Toyota Camry, Tesla Model 3, and Honda Civic remained top passenger car choices in 2024. In the light truck segment, the Tesla Model Y led, followed by the Toyota RAV4 and Honda CR-V. These top-selling models provide benchmarks for manufacturers when designing and releasing new vehicles in these popular segments. The ongoing popularity of models like the Camry and RAV4 highlights the enduring appeal of established nameplates, while the strong performance of Tesla models underscores the continued interest in EVs, albeit with shifting market dynamics as noted earlier.

Regional variances within California also offer insights for new car releases. Northern California saw a larger decline in passenger car registrations but a smaller rise in light trucks compared to Southern California. ZEV market share was slightly higher in Northern California (25.1%) than in Southern California (22.7%). These regional differences may influence the types of new car releases that are most successful in different parts of the state, with manufacturers potentially tailoring their offerings to regional preferences.

In conclusion, the CNCDA’s 2024 Auto Outlook Report paints a nuanced picture of the California auto market. While overall registrations are stable and projected to grow, significant shifts are occurring beneath the surface. Tesla’s EV dominance is being challenged, hybrids are gaining considerable traction, and brand rankings are evolving. For consumers and industry professionals alike, understanding these trends is vital for navigating the landscape of new car releases and anticipating future market developments in California, a bellwether for automotive trends nationwide. This report underscores the dynamic nature of the automotive industry and the importance of staying informed about evolving consumer preferences and technological advancements as manufacturers continue to innovate and release new vehicles.