The California New Car Dealers Association (CNCDA) has released its Year End 2024 California Auto Outlook Report, offering a comprehensive analysis of new vehicle registrations across the state. While the overall California new car market remains robust, the report highlights a significant trend: Tesla, a dominant force in the electric vehicle (EV) sector, is experiencing a notable shift in its market share. This comes as hybrid vehicles gain increasing traction with California consumers, suggesting an evolving landscape in automotive preferences.

California Auto Outlook Report 2024 Cover: Analysis of new car registrations and market trends, including Tesla's performance and the rise of hybrid vehicles.

California Auto Outlook Report 2024 Cover: Analysis of new car registrations and market trends, including Tesla's performance and the rise of hybrid vehicles.

Tesla’s Market Share in California’s New Car Sector Faces Headwinds

For those closely watching New Car Tesla registrations, the latest report reveals a fifth consecutive quarterly decline for the automaker in California. In the fourth quarter of 2024, Tesla registrations decreased by 7.8 percent, contributing to a substantial 11.6 percent drop throughout the entire year. This downturn has impacted Tesla’s commanding position in the Zero Emission Vehicle (ZEV) market. While still holding a majority share, Tesla’s ZEV market share in California has fallen by 7.6 percentage points in 2024, settling at 52.5 percent. Looking at the broader California new car market, Tesla’s overall share is now 11.6 percent, down from 13 percent the previous year. This indicates that while new car Tesla vehicles remain popular, their growth is slowing compared to previous periods.

Hybrid Vehicles Gain Ground as California Consumers Diversify Choices

Interestingly, while the new car Tesla market share adjusts, the report points to a growing appetite for hybrid vehicles among Californians. The overall ZEV market share in California experienced a slight dip in Q4 2024, decreasing to 21.3 percent from 23.7 percent in the previous quarter. However, the broader category of alternative powertrains, which includes both ZEVs and hybrids, actually increased its overall share. Hybrids specifically played a key role, offsetting the ZEV decline by gaining 2.4 percentage points in Q4 – matching the exact percentage point drop seen in ZEV registrations. This trend suggests a potential shift in consumer behavior, where buyers may be opting for hybrid vehicles as a transitional step before fully embracing all-electric new car Tesla models or other ZEV options. This could be influenced by factors such as range anxiety, charging infrastructure concerns, or simply a preference for the established technology and versatility of hybrid powertrains.

Overall California New Car Registrations Show Stability and Positive Projections

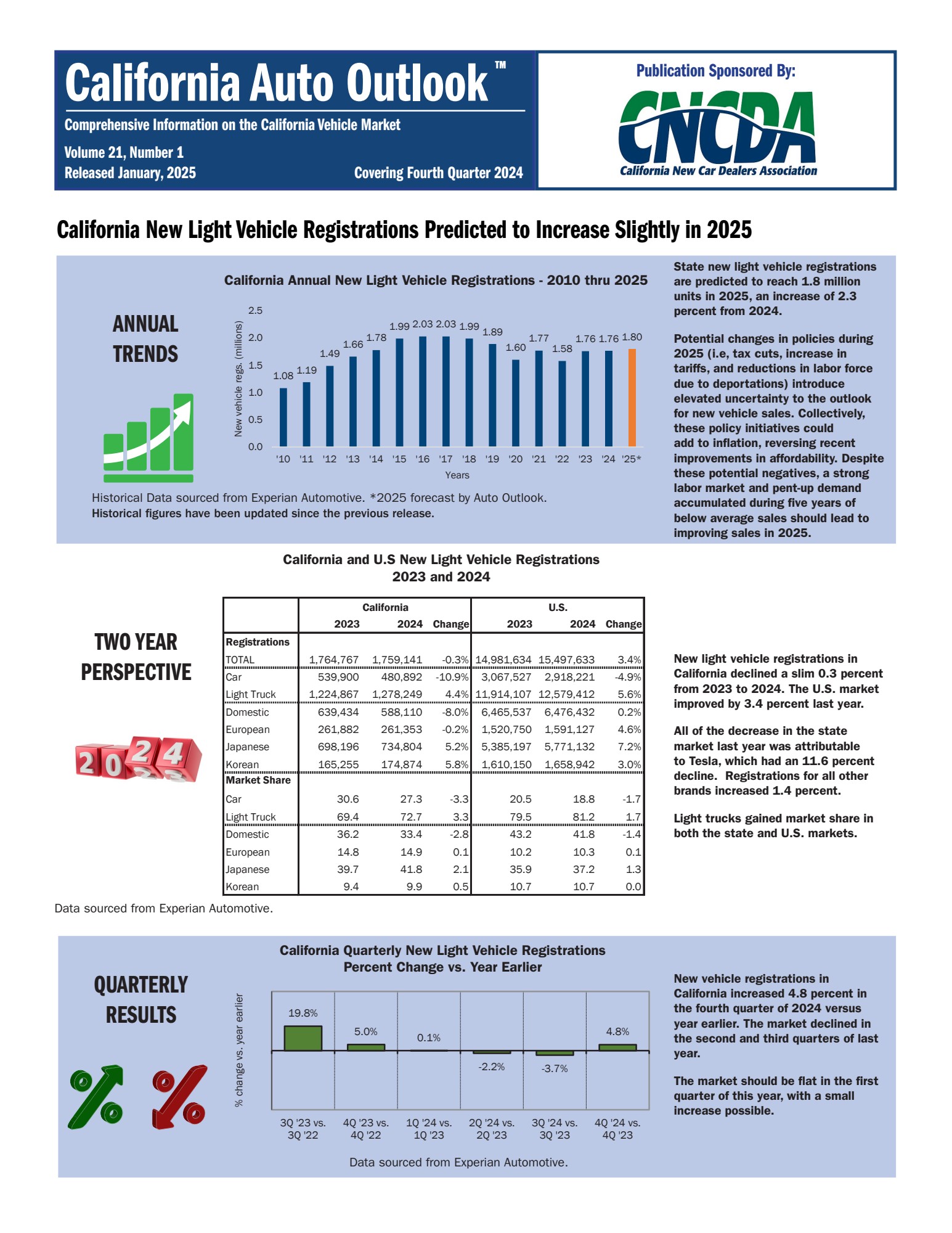

Despite the shifts within the EV and hybrid segments, the overall California new car market demonstrates stability. In 2024, total light vehicle registrations in California reached 1,759,141, showing a minimal decrease of only 0.3 percent compared to 2023. Looking ahead, the forecast for 2025 is optimistic, with projections indicating a slight increase in registrations to 1.80 million vehicles. Furthermore, the fourth quarter of 2024 showed a positive upward trend, with new vehicle registrations increasing by 4.8 percent compared to the same period in 2023, setting a positive tone for the new year.

The report also highlights brand performance across the California market. Toyota remains the dominant brand with 289,258 registrations in 2024, capturing 16.4 percent market share. Following Toyota, Tesla and Honda are key players, each holding around 10.9 percent market share. Notably, Honda experienced an 11.5 percent increase in registrations in 2024. Several brands, including Lincoln, Land Rover, Cadillac, and Buick, saw impressive registration growth of 20 percent or more in 2024, indicating dynamic shifts in brand preferences within the California new car landscape. In terms of popular models, the Toyota Camry, Tesla Model 3, and Honda Civic were top passenger cars, while the Tesla Model Y, Toyota RAV4, and Honda CR-V led the light truck segment in California for 2024.

According to Robb Hernandez, CNCDA Chairman, “As dealers, our primary goal is to offer the vehicles that Californians actually want to drive… It’s not about mandates or pushing one type of powertrain over another—it’s about having the right inventory on our lots to serve the needs of real customers and our communities.” This statement underscores the importance of adapting to consumer demand and offering a diverse range of vehicle options, from new car Tesla models and EVs to hybrids and traditional internal combustion engine vehicles.

For a detailed breakdown of California’s new car market trends, including segment rankings, regional data, and further analysis, access the full Year End 2024 Auto Outlook Report here.