California’s automotive landscape is undergoing a fascinating shift, according to the latest California Auto Outlook Report from the California New Car Dealers Association (CNCDA). While overall new car registrations remain robust, the electric vehicle (EV) market is showing signs of deceleration, with hybrid vehicles stepping in to capture consumer interest. This report, based on data from Experian Automotive, provides a comprehensive look at the trends shaping the Golden State’s automotive sector.

CNCDA California Auto Outlook Report 2024 Cover

CNCDA California Auto Outlook Report 2024 Cover

Tesla’s EV Dominance Faces Headwinds

Tesla, a brand synonymous with electric vehicles, is experiencing a notable slowdown in its home market. The report reveals Tesla’s fifth consecutive quarterly decline in new car registrations in California. In the fourth quarter of 2024, Tesla registrations decreased by 7.8 percent, contributing to an overall 11.6 percent drop for the entire year. This dip has impacted Tesla’s market share within the Zero Emission Vehicle (ZEV) segment, falling to 52.5 percent, a 7.6 percentage point decrease from the previous year. Across the entire California new car market, Tesla’s share has also contracted from 13 percent in 2023 to 11.6 percent in 2024. This data suggests that while Tesla remains a significant player, its previously unchallenged dominance in the California EV market is being tested.

Stable Overall New Car Registrations Point to Market Resilience

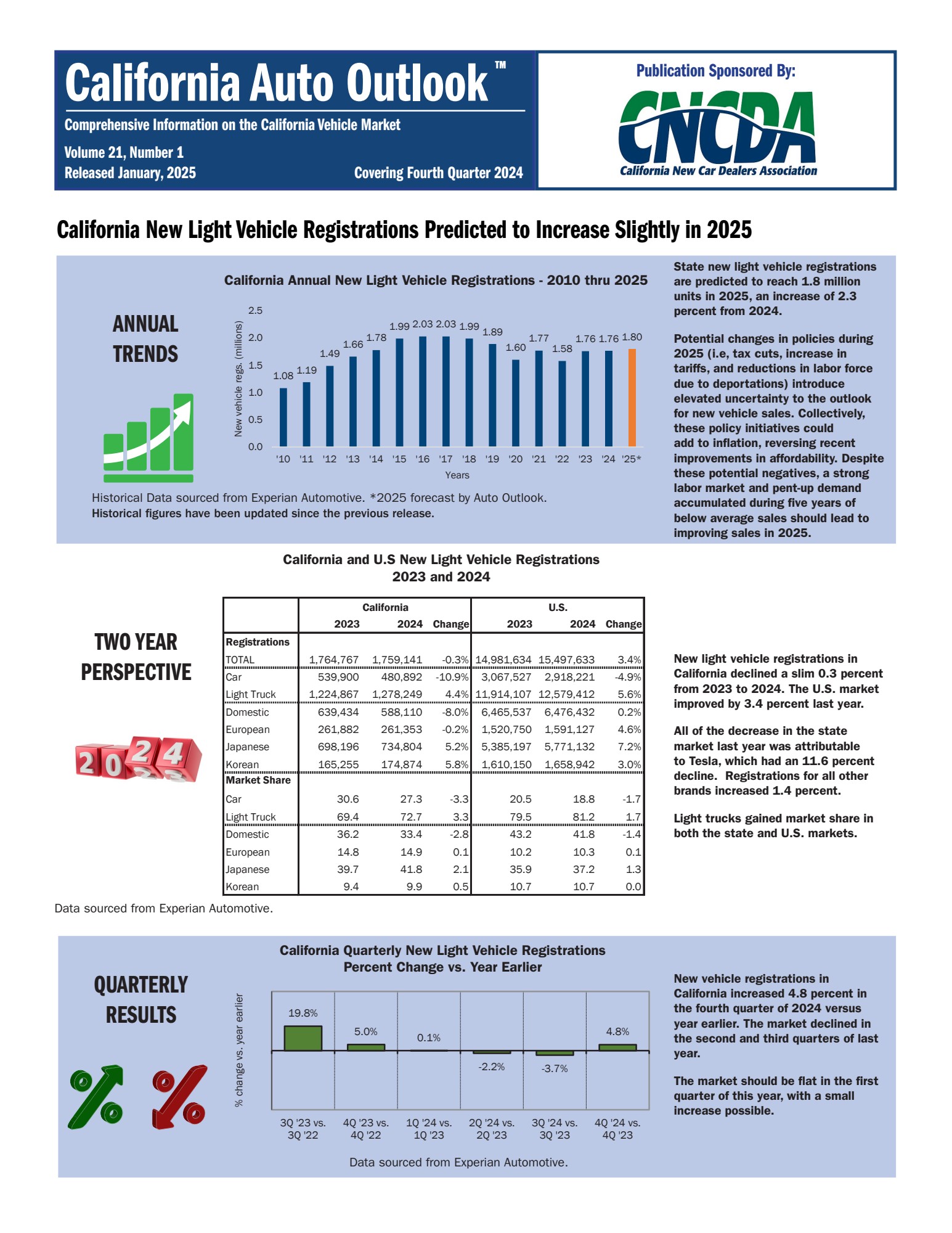

Despite fluctuations within the EV sector, the overall California new car market demonstrates stability. In 2024, a total of 1,759,141 new light vehicles were registered in California, showing a marginal decrease of just 0.3 percent compared to 2023. Looking ahead, the forecast for 2025 is positive, with projections indicating a slight increase to 1.80 million new car registrations. The fourth quarter of 2024 showed a promising 4.8 percent increase in new vehicle registrations compared to the same period in 2023, suggesting positive momentum as we enter 2025, although the first quarter is anticipated to be relatively flat. This steadiness in new car registrations underscores the underlying strength of the California automotive market.

Hybrid Vehicles Emerge as a Popular Choice

A key trend highlighted in the report is the evolving consumer preference within the alternative powertrain market. While the ZEV market share experienced a slight decrease to 21.3 percent in Q4 2024 (down from 23.7 percent in Q3), hybrid vehicles have gained significant traction. For the year, alternative powertrain registrations reached 40.2 percent, and an even stronger 42.2 percent in Q4. Notably, the decline in ZEV market share in Q4 was directly mirrored by a 2.4 percentage point gain in hybrid registrations. This indicates a growing segment of California new car buyers are opting for hybrids as a transitional technology, bridging the gap between traditional internal combustion engines (ICE) and fully electric vehicles. The appeal of hybrids likely lies in their combination of fuel efficiency and reduced emissions without the range anxiety associated with some EVs.

Brand and Model Standouts in the California Market

Toyota continues to reign supreme in the California new car market, securing the top spot with 289,258 registrations in 2024, a 4.4 percent increase year-over-year, and capturing a 16.4 percent market share. Following Toyota in market share are Tesla and Honda, both holding 10.9 percent. Honda experienced an impressive 11.5 percent increase in registrations in 2024, reaching 192,166 units. Several brands demonstrated remarkable growth in registrations in 2024, including Lincoln (27.6 percent), Land Rover (22 percent), Cadillac (21.7%), and Buick (21.7 percent).

In terms of model segment leadership, the Toyota Camry topped the passenger car segment, while the Tesla Model 3 and Honda Civic were closely tied for second place. For light trucks, the Tesla Model Y led the way, followed by the Toyota RAV4 and Honda CR-V. These model rankings reflect the diverse preferences of California new car buyers across different vehicle types.

Regional New Car Market Variations within California

The report also highlights regional differences within California’s new car market. Northern California witnessed a 12.6% decrease in passenger car registrations but a 1.5% increase in light truck registrations. ZEVs accounted for a significant 25.1% of the Northern California market share. Southern California experienced a similar trend, with passenger car registrations declining by 10.3% and light truck registrations increasing by 5%. ZEVs represented 22.7% of the Southern California market. These regional variations may be attributed to factors such as demographics, infrastructure, and local market conditions influencing new car preferences.

Conclusion: A Dynamic California New Car Market

The California Auto Outlook Report paints a picture of a dynamic and evolving new car market. While the overall market remains stable with projected growth, significant shifts are occurring beneath the surface. The cooling momentum in the EV sector, particularly for Tesla, coupled with the rising popularity of hybrid vehicles, signals a change in consumer preferences. As California continues to lead the nation in vehicle technology adoption, these trends will be crucial for automakers and dealerships to navigate. For a deeper dive into the data and further insights, access the full EOY 2024 Auto Outlook Report here.