Deciding whether to lease or purchase a new car is a significant financial decision. For any car enthusiast, especially one with years of experience navigating the automotive world, choosing wisely is crucial. Leasing and purchasing both present unique advantages and disadvantages, and understanding these can help you make the most financially sound choice for your needs.

Both leasing and purchasing cars have been options I’ve considered and utilized over the years. Each path has its own set of pros and cons that are important to weigh.

The Crossroads: Leasing or Purchasing

After a decade of reliable service, it was time to say goodbye to my trusty old Land Rover Discovery II, affectionately nicknamed “Moose.” Age and mounting repair costs made it impractical to keep him on the road. Parting ways with Moose, a vehicle that had been a part of so many adventures, was bittersweet.

I remember finding Moose back in 2005, a diamond in the rough on Craigslist with 87,000 miles and a $10,000 price tag. The previous owner, relocating for a job, needed a quick sale, and we settled on a fantastic $8,000. From there, Moose became my companion on countless trips.

Ferrari Enzo – Deciding On Leasing Or Purchasing A New Car

Ferrari Enzo – Deciding On Leasing Or Purchasing A New Car

Truthfully, driving in today’s world, especially in congested areas, can be less than enjoyable. Increased traffic density in urban centers has made driving a more stressful experience than it once was. The thought of forgoing car ownership altogether and relying on ride-sharing services even crossed my mind. However, the independence and freedom a personal vehicle provides ultimately won out.

Leaning Towards Leasing: A Path of Simplicity

When faced with the lease-versus-purchase dilemma, I ultimately opted for leasing a new car, primarily for its simplicity and flexibility.

The decision process involved considering various options, including a Jeep Grand Cherokee Limited and a Honda Fit EX. Practical considerations, like vehicle registration and smog checks for my aging Land Rover, pushed me to make a change. The looming renewal fees and the persistent “service engine” light on Moose’s dashboard signaled that it was time for a more reliable option.

Addressing the check engine light and replacing worn tires on Moose would have incurred unexpected costs and time. While exploring purchase options, an unenthusiastic dealership experience further steered me towards a different direction. The appeal of a new, fuel-efficient car with modern features began to grow.

At a Honda dealership, a silver 2015 Honda Fit, fully equipped, caught my eye. It was the right size, offered excellent features, and felt like a smart, practical choice for city driving.

Features That Mattered: The Honda Fit’s Appeal

Here’s a breakdown of the appealing features of this Honda Fit:

- Backup camera

- Right side view mirror camera

- 16″ alloy wheels

- Compact dimensions: 160″ long, 67″ wide, 60″ tall (compared to Moose’s larger size)

- Enhanced safety: 6 airbags from 8 compartments

- Improved horsepower: 130 hp (up from 117 hp in previous models)

- Modern connectivity: Two USB ports, 1 120V port, and 1 HDMI port

- Versatile “Magic Seats” for flexible cargo space

- Paddle shifters

- Bluetooth for hands-free calls and media streaming

- Moonroof

Leasing the Honda Fit: Value and Practicality

Honda Fit 2015

Honda Fit 2015

The array of features in the Honda Fit was a welcome upgrade from my older car. The convenience of charging devices on the go and easily navigating tight parking spots in the city were significant advantages. Safety was a key consideration given the Fit’s smaller size. Research confirmed that the 2015 Honda Fit had achieved top safety ratings, addressing previous model concerns.

While perhaps not as imposing as Moose, the Honda Fit represented a financially responsible and environmentally conscious choice. Confidence in one’s decisions transcends the type of car driven. Moving from larger, more expensive vehicles to a compact car felt liberating and aligned with a focus on practical wealth.

Leasing, in this context, offered a way to prioritize financial prudence without sacrificing modern features and reliability. It reflects a strategic, almost “samurai-like” approach to car ownership – prioritizing practicality and value.

The Lease vs. Purchase Decision Framework

Lease rates have shifted over time, making leasing a more competitive financial option. The price difference between leasing and purchasing has narrowed significantly, altering the traditional perception of leasing as a less economical choice.

Optionality became a central factor in my decision to lease. A lease provides the flexibility to reassess needs at the end of the term. The option to purchase the car at its residual value or transition to a different vehicle after three years is valuable.

The Value of Optionality in Leasing

Life circumstances change. Future needs might necessitate a larger vehicle, or perhaps the current car won’t perfectly suit all conditions. Leasing offers a hedge against these uncertainties. Having recently invested in a house, committing a large sum to a depreciating asset like a car felt less appealing.

While I once enjoyed the process of negotiating car purchases and sales, priorities shift. Time and convenience become increasingly valuable. Paying a premium for these aspects becomes justifiable. The desire to avoid being “stuck” with a car long-term, in case it doesn’t meet evolving needs, further solidified the leasing decision.

Understanding Lease Costs

Here’s a breakdown of the lease agreement:

- $0 down payment (sign and drive).

- $1,000 trade-in value for the old Land Rover.

- $20,117 total cost after trade-in, taxes, and fees.

- $235 monthly lease payment (compared to a $604 monthly purchase payment over 3 years at 0.9% interest).

- $8,462 total lease payments over 3 years.

- $12,746 residual value (purchase option after 3 years).

- Total lease cost (payments + residual) = $21,208.

- Purchase cost (cash) = $20,117.

The Cost Comparison: Lease vs. Purchase

In this scenario, leasing the car with the option to purchase after three years amounted to a relatively small premium of $1,091 (5.4%) compared to an outright cash purchase. The flexibility and optionality provided by leasing were worth more than this marginal cost difference. Furthermore, the potential to earn a return on the capital not tied up in the car further justifies the lease. Even financing the purchase would only marginally reduce the cost compared to leasing.

A monthly lease payment of $235 represents a small percentage of monthly cash flow and can be easily managed. The total vehicle cost also aligns with responsible car buying guidelines.

Leasing Recommendations: Is it Right for You?

Consider leasing if you:

- Drive under 12,000 miles annually.

- Value the flexibility to change vehicles every few years.

- Enjoy driving new cars.

- Prefer to avoid long-term car maintenance responsibilities.

- Are uncertain about future vehicle needs.

- Prioritize monthly cash flow.

- Dislike the hassle of selling a car.

Remember to consider the after-tax cost of car ownership, especially if you can deduct lease payments as a business expense. Leasing or purchasing is a strategic financial decision, and understanding your priorities is key.

Honda Fit vs. Tesla – Deciding On Leasing Or Purchasing A New Car

Honda Fit vs. Tesla – Deciding On Leasing Or Purchasing A New Car

Strategic Car Ownership: Lease or Buy with Purpose

Car ownership inherently involves costs beyond the initial price, including maintenance, insurance, and other recurring expenses. These costs accumulate and should be factored into any car decision.

It’s easy to overlook expenses like car insurance. Switching to a newer, leased vehicle often necessitates more comprehensive and thus more expensive insurance coverage. This increase in insurance costs is a real factor to consider.

To minimize car ownership costs, prioritize reliability, maintain your vehicle diligently, shop around for insurance, and drive responsibly. Adhering to sound financial principles in car buying is essential.

Always view a car as a financial liability. Consider how your vehicle fits into your overall financial strategy. For those with newer vehicles, exploring options to generate income through ride-sharing or delivery services could offset some ownership costs.

Ultimately, both leasing and purchasing can be viable paths to car ownership. The “Samurai Car decision” – the wise and strategic choice – depends on aligning your car decision with your individual financial situation and lifestyle needs. By carefully weighing the pros and cons and considering your priorities, you can make a car choice that is both practical and financially sound.

Related posts:

The Best Time Of The Year To Buy A Car

The Best Mid-Life Crisis Cars To Buy

Financial Responsibility: Choosing a Sensible Vehicle

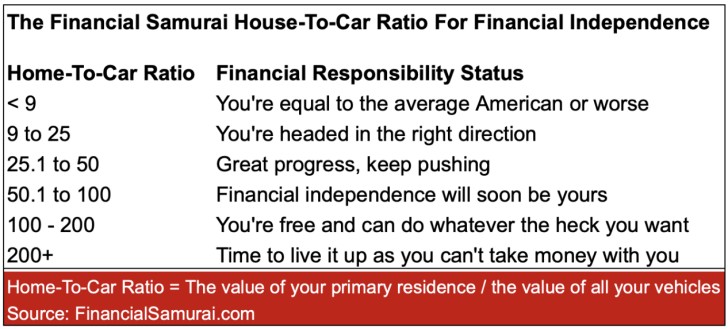

Adopt a responsible approach to car buying by following sound financial guidelines. Align your vehicle expenses with your overall financial goals. Prioritize building wealth and financial freedom over driving an excessively expensive car.

House-To-Car Guide for financial freedom

House-To-Car Guide for financial freedom

Invest in Assets, Not Just Liabilities

Minimize car expenses and redirect funds towards wealth-building assets like real estate. Investing in real estate offers the potential for appreciation and long-term financial security, providing greater value than a depreciating car.

Consider exploring real estate investment platforms like Fundrise and Crowdstreet to diversify your investments and generate passive income. Building wealth strategically provides true financial freedom.

Stay Informed with Financial Samurai

For more insights on personal finance and strategic financial decisions, subscribe to the Financial Samurai podcast on Apple or Spotify. Join the Financial Samurai newsletter for in-depth personal finance content and updates.